A Net-Zero Economy Requires a Net-Zero Financial System

Ivey Foundation Vice President Andrea Moffat says “it’s time to move from discussion to implementation”

A net-zero economy requires a net-zero financial system seems like an obvious statement – of course the economy and finance need to be aligned to meet Canada’s net-zero commitment by 2050 and the milestones along the way. However, like every complex problem it is easier said than done, with the devil in the details – and there are a lot of details.

What is net-zero transition and what does it cost?

In simple terms, ”net zero” refers to all efforts to reduce greenhouse gas emissions (GHGs) at the source, together with natural and technical methods of removing greenhouse gases either from emission sources or directly from the air. The net of all emission reductions and all greenhouse gas capture must meet or be lower than zero by 2050. It is widely recognized that reaching net zero requires substantial transformation of many systems which provide the backbone to how society functions such as our energy, transportation, and agricultural systems amongst others.

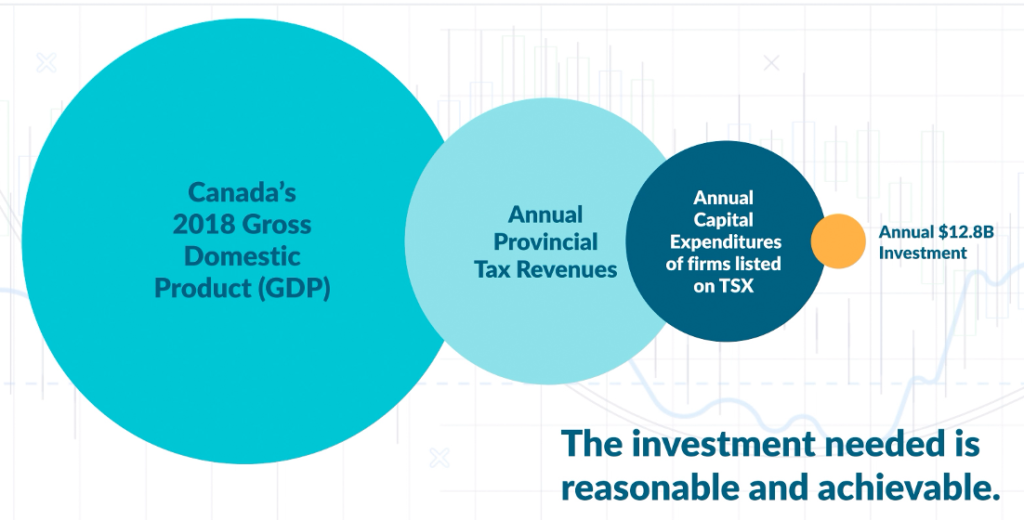

A useful tool for understanding the potential pathways for different sectors of the economy to transition towards net zero in Canada has been produced by the Transition Accelerator for use by businesses, government and investors in their analysis and decision-making. The scale and the number of sector and system transformations will require a great deal of capital and investment and most of this will need to come from the private sector. The Institute for Sustainable Finance analysis of the investment required for Canada to meet its now old 2030 target of 30% reduction in GHGs taking into account all sectors were estimated at $12.8 billion per year.

This analysis also indicated that private capital can achieve at least 50% of the required investment and determined that this could be accomplished if 5% of normal annual capital expenditures by large publicly traded firms were focused on carbon abatement projects over the next ten years.1

From: Institute for Sustainable Finance presentation Oct. 21, 2020.

How do we get a net-zero aligned financial system?

There are a lot of changes at the global, national and regional level that need to be made to align financial policies and regulations to account for climate impacts and mitigation. The overall goal of aligning the financial system with net-zero commitments is to drive private investment and capital to fund this transition. The federally appointed Canadian Expert Panel on Sustainable Finance took up the challenge of developing a strategy for Canada and released recommendations in the spring of 2019. The formal and informal consultation process that was undertaken to develop and test these recommendations before their release was the most in-depth discussion on sustainable finance that has occurred in Canada to date with hundreds of people involved from the financial sector, corporations, government, academia, NGOs and other experts.

The final recommendations provide a good start on the areas that need to be addressed for Canada to fund the transition to net zero. What is clear from the recommendations is the need for a breadth of policy innovations and developments to integrate climate risks and opportunities into financial decision-making. One example of the most pervasive issues that was identified by the Expert Panel and has been widely supported by financial sector organizations, is the challenge with accessing high quality, comparable climate data and information.

Data is the foundation for investment decisions

Capital is starting to flow towards net-zero transition and sustainable finance, however, to accelerate this process over the near term there is a need to provide transparent, comparable and easily accessible climate, energy and physical risk data from government sources and from business disclosures.

The government is working to organize and provide easier access to climate and energy data in Canada, through the recent creation of Climate Data Canada and the Canadian Centre for Energy Information. However, more needs to be done to improve the timelines of the data – Canada’s GHG data for 2019 was only released in 2021 – and to ensure that the data that are available can be downloaded easily into useable formats for analysis by all stakeholders, including investors. Delayed and difficult to assimilate data will not support the inclusion of climate risks and opportunities into investment decision-making.

In terms of access to business disclosures on financially material climate risks and opportunities there is building global support for using the Task Force on Climate-related Financial Disclosures (TCFD) recommendations as the starting point for mandatory requirements in many jurisdictions. Globally there are over 900 financial firms supporting TCFD with over $22.4 trillion in assets under management, and a number of jurisdictions are moving to mandatory disclosure including New Zealand and the UK.2 Canadian calls for TCFD disclosure include amongst others the largest Canadian pension funds, and a group of banks, asset managers, pension funds and experts who are collaborating to call for mandatory TCFD disclosure as part of the Ontario Capital Markets Modernization Taskforce recommendations.

The Federal government has publicly supported the TCFD and is requiring Crown Corporations to report using it as a basis for climate disclosures, as well as Large Employer Emergency Financing Facility (LEEF) recipient companies. In Budget 2021 the government also committed to engage with the provinces and territories on making climate disclosures consistent with the TCFD. There are strong indications that TCFD aligned climate disclosures will become the baseline for corporate reporting and this could help to alleviate over time, the challenges with inconsistent, and lack of comparable firm level data. However, there are still a lot of granular details to be understood in terms of methodologies, definitions, assurance and accounting requirements.

Addressing the climate data challenge is just one example of the foundational requirements raised by the Expert Panel that needs to be addressed to increase private financing for Canada’s net-zero transition. It illustrates how international efforts can be leveraged to drive more action in Canada, but it also demonstrates how complex the challenge is to re-align financial systems to support a net-zero economy. The goal of net-zero transition will only be realized if we accelerate the urgency of aligning our financial system to net zero so that the energy system and other sector transitions will be financed and built over the coming decade. It is time to move from discussion to implementation.