A Transformative Energy Investment Asset Class

In this week’s article Chris Henderson explores the concept of a Transformative Energy Investment Asset Class, a framework designed to guide capital toward the energy transition. It examines how market guardrails, income amplification, and capital intermediaries can improve project quality, expand investment opportunities, and accelerate deployment, while generating broader social, environmental, and economic benefits.

A Transformative Energy Investment Asset Class

I have enjoyed more than a few laughs watching sketches of the British Comedy Troupe, Monty Python’s Flying Circus. Well, that is certainly dating me!

The Python lads also put out some hilarious tunes. My favourite is the Money Song with capitalistic opening lyrics …

I’ve got ninety thousand French francs in my fridge

I’ve got lots of lovely Lire

Now the Deutschmark’s getting dearer

And my dollar bills would buy the Brooklyn bridge

There is nothing quite as wonderful as money

There is nothing quite as beautiful as cash

Some people say it’s folly

But I’d rather have the lolly

With money you can’t make a splash

Humour aside, is it timely and vital therefore to consider the concept of a Transformative Energy Asset Investment Class as one arrow in the quiver to finance a 21st century energy economy? To reinforce project and venture quality, amplifying yields and unlocking reliable and competitive opportunities for investors and lenders.

Friend and colleague, Lida Preyma Founder and CEO of https://celandairecapital.com/ and I have written a Commentary on the concept of a Transformation Energy Investment Asset Class which can be read or downloaded here and from the https://transformativeenergy.ca/ platform. A summary of key points follow.

I would like to note that Lida’s company Cēlandaire Capital offers curated capital introduction for strategic investment by financiers and advisory for corporate climate projects. www.celandairecapital.ca

From Transformative Energy

A Transformative Energy Investment Asset Class

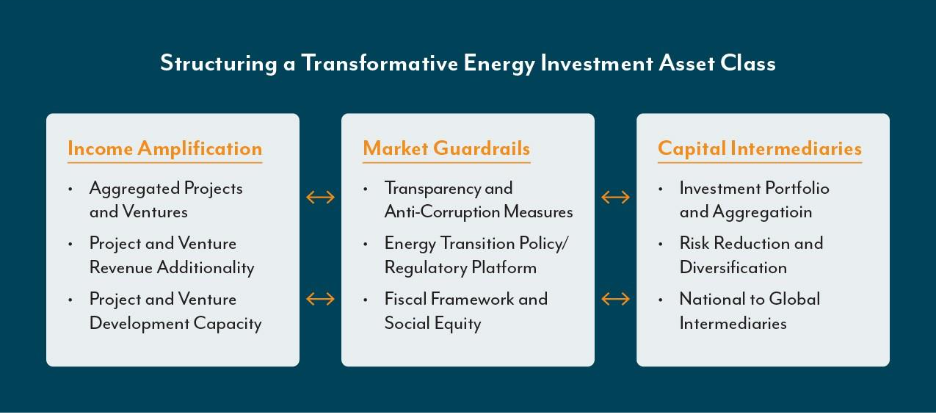

“We propose that a Transformative Energy Investment Class needs to be underpinned by Market Guardrails, Income Amplification and Capital Intermediaries as illustrated below. The structure places primacy on three economic outcomes: a) higher quality energy transition projects, ventures and infrastructure opportunities for investors, with lower risk and higher yield, b) dramatically increasing the pipeline, scale and replicability of investment opportunities with more consistent definitions and offerings, and c) more efficient and effective investment transactions, in effect, quickening the pace of capital investment and deployment.

Market Guardrails are a different approach to positioning the role of governments and public agencies.

- Of crucial importance are public standards and oversight for market Transparency and Anti-Corruption Measures. Such actions substantively increase investor confidence and investment performance.

- Government directives for energy futures are essential, though it may be more effective to build an Energy Transition Policy/Regulatory Platform over time rather than one-off media-catching public pronouncements.

- Taxation arrangements, of all kinds – capital gains, excise, trade, corporate, consumption and personal taxes – in addition to well-designed, targeted public expenditures, provide Fiscal Frameworks and Social Equity for energy transition investment.

Income Amplification puts a premium on realizing higher investment performance in energy transition projects, ventures, and infrastructure within a portfolio

- Vectoring away from one-off transactions towards Aggregated Projects & Ventures. Size matters, both in terms of investee scale and number.

- Many energy transition investments have the potential to yield Project & Venture Revenue Additionality beyond conventional commercial earnings. This can include monetizing public good benefits such as ecological (nature) impacts, valuing carbon mitigation, or wiring in externalities such as improved societal health outcomes into investment terms.

- We are in the awkward teenager stage of energy transition, and entrepreneurship and skills enhancement to improve Project & Venture Development Capacity will improve, and can be advanced through AI, shared learning, and educational modalities.

Capital Intermediaries are vitally important as the “glue” binding together the components of a Transformative Energy Investment Asset Class. The number and transactional capacities of Intermediaries must rise.

- Intermediaries should lead energy transition Investment Portfolios and Aggregation facilitating transactions at scale, and at lower cost.

- By grouping energy transition project, venture, and infrastructure investments, Intermediaries become the trusted market marshals that advance Risk Reduction and Diversification.

- Intermediaries have specialties in countries or regions, or specific sectors and markets. However, it is important that they also create networks and neural connections that take functioning from National to International interaction. In effect, be both local and global.”