Building Efficiency to Combat Climate Change: How One Company’s Methods Generate Value for All

Canada invests approximately $6 billion annually in efficiency upgrades, which is far below the $30 billion needed annually to achieve our climate goals for the low-carbon economy. This under-investment has persisted over the years and even though there has been significant new legislation and policies developed to change this, it hasn’t been enough. Canada and Ontario are on track to miss their 2030 target of a 30% reduction in greenhouse gas (GHG) emissions.

In urban areas, buildings account for 40% of GHG emissions, despite being one of the most affordable ways to reduce overall emissions. As the building stock ages, equipment and infrastructure become outdated or obsolete; their inefficiency leads to significant GHG emissions and decreased occupant comfort, and health and safety. Efficiency retrofits offer a way to create significant positive financial, environmental, and social impacts.

The positive benefits of energy efficiency investments have been known for a long time – solid returns on investment, reduced consumption of electricity, natural gas and water, commensurate reductions in emissions, and improvements in indoor environmental quality (IEQ) that greatly impact the physical and mental health of building occupants. And yet, decade after decade, energy efficiency has seen underinvestment. The problem is systemic and the usual approach of incentives for specific upgrades has failed to deliver the deep investments needed.

Enter Efficiency Capital, an efficiency solutions developer and investor-driven to create sustainable and substantial change across Canada. The company’s approach solves the consistent and long-standing barriers to energy efficiency and enables the implementation of deep retrofits. Efficiency Capital develops, invests in, and manages efficiency retrofits that are guaranteed to achieve savings, with its innovative third-party investment and ownership model that is familiar to the world of infrastructure, but new to real estate and business operations.

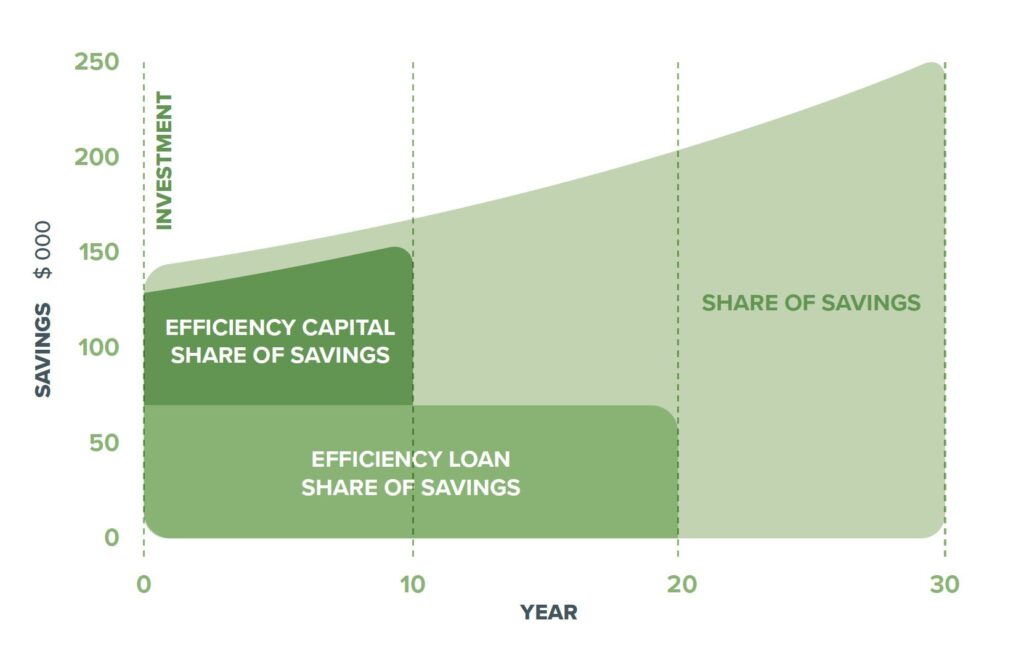

Efficiency Capital’s innovation shines in that it re-organizes the supply side of efficiency retrofit transactions, including: (1) bringing new sources of capital into the sector via a “project equity” style of investment, (2) creating a de-risking and enabling platform where the company can deploy certain clean technologies in its projects when normally clients can’t (or won’t) pay for it themselves, and (3) creating a method for providing comprehensive and integrated efficiency solutions when normally clients complete them in piecemeal fashion over longer periods of time. The investment is paid back based on savings generated over the contract length, which is typically around 10 years. This means that the client does not pay if the savings don’t materialize. As an added reassurance, these annual savings are audited by an independent third-party verification firm.

“Building owners have become comfortable with how things have been done for decades and the concept of third-party ownership of energy efficiency equipment was novel at the time of Efficiency Capital’s inception,” says Chandra Ramadurai, CEO of Efficiency Capital. “It’s unfortunate, but that sentiment still exists across corners of Canada to this day. Market transformation involves significant education, handholding, and trust building, especially as several building owners have become jaded to the concept of efficiency retrofits as they’ve attempted projects that haven’t yielded the value they were looking for or weren’t properly measured for owners and operators to see the full extent of the value generated.”

Over the past two years, Efficiency Capital has worked to transform the market in terms of how they receive energy efficiency. At the heart of its innovation is a third-party, private partnership model where the company develops, invests, owns, and operates efficiency upgrades in client buildings, in exchange for an ongoing service fee.

“The model is fundamentally good for a building’s bottom line. Because we own and operate upgrades, our method helps reorganize building finances as well as infrastructure,” continues Ramadurai. “Owners and operators are able to conserve their capital or reallocate what would have been spent on updating old equipment into funding further upgrades or amenities for tenants. Upgrades generate an increase in valuation in several ways, and as the retrofits are kept off the balance sheet, it leaves borrowing power unchanged to help facilitate other value-generating upgrades.”

In addition to the financial return, the company also measures the environmental return through the GHG savings of every investment it makes. “Efficiency Capital has not and will not invest any dollars in carbon-increasing projects,” says Matt Zipchen, President of Efficiency Capital. “We’ve also started the process to measure social returns such as improvement in indoor environmental quality (IEQ) and improved health outcomes.”

Measurement is a simple way to see and evaluate the impact Efficiency Capital has made over the past two years alone, with its initial projects estimated to achieve: over $10M in utility savings; over $8M in avoided capital costs; over 10,000 tons in GHG emission reductions; over 20 million kWh reduction in electricity consumption; over 5 million m3 reduction in natural gas consumption; and over 1 billion litres (1 million cubic metres) reduction in water usage.

“Standardized reporting is a critical part of market transformation, and a core value for Efficiency Capital,” continues Zipchen. The company’s recent flagship efficiency project became the very first in Canada certified under the Investor Confidence Project’s Investor Ready Energy Efficiency™ (IREE) certification, delivered by Canada Green Building Council (CaGBC) and Green Business Certification Inc. – the global certification body for the LEED green building program.

While its work is centred around mitigating climate change across Canada, Efficiency Capital has created a new ecosystem to deliver its new class of investment, with a goal of inspiring even more third-party investors to step up to the plate. Despite buildings being one of the most affordable ways to reduce GHG emissions, in this age of large government budget deficits, private investment is the ideal option for funding these upgrades.

Efficiency Capital’s actions have driven market change in unexpected ways, inspiring a first-of-its-kind project with a large social housing provider in Ontario. As a leader in the field, the housing provider’s adoption of this new model has cascaded into other social housing providers who are interested in achieving the same value for their buildings and tenants. In addition, a funding partnership with one of the largest community foundations (Toronto Foundation) has sparked an Ontario-wide social housing readiness initiative designed to make efficiency and infrastructure upgrades easier and more accessible to not-for-profit housing providers.

Bringing about fundamental change to any marketplace or industry is never the act of one or two individuals, or of one company alone. While Efficiency Capital may be a catalyst to significant change in the building efficiency sector, all stakeholders in the industry need to work together to reach a brighter, cleaner, and more efficient future.