Rainbows and Headwinds: Canada’s Clean Hydrogen Future

While hydrogen holds promise in our energy future, challenges persist, including high costs, storage issues, and underdeveloped markets. Despite obstacles, governments can facilitate progress through policies, incentives, and recognizing regional nuances, driving innovations in hydrogen applications across various sectors.

Hydrogen and Global Change

Discussions around hydrogen are often framed in a rainbow: green hydrogen made using renewable energy; blue hydrogen made from natural gas or coal with carbon capture, utilization and storage (CCUS); pink hydrogen from low-emissions nuclear power. These colours represent improvements, in climate terms, on the grey and black hydrogen, made with unabated natural gas and coal, that make up 99% of the world’s production today.

Most of this hydrogen is used in oil refining, chemicals, and steel industries. But many are looking to a future in which hydrogen will be used to store renewable electricity, power fuel-cell vehicles like buses and ships, and generate e-fuels for hard to abate sectors like aviation and long-haul shipping. Today these “modern” applications represent only a fraction of 1% of the world’s hydrogen consumption. But the promise of hydrogen in our energy future represents big opportunities for clean investment and employment – so long as the policy and marketplace cooperate to make it work.

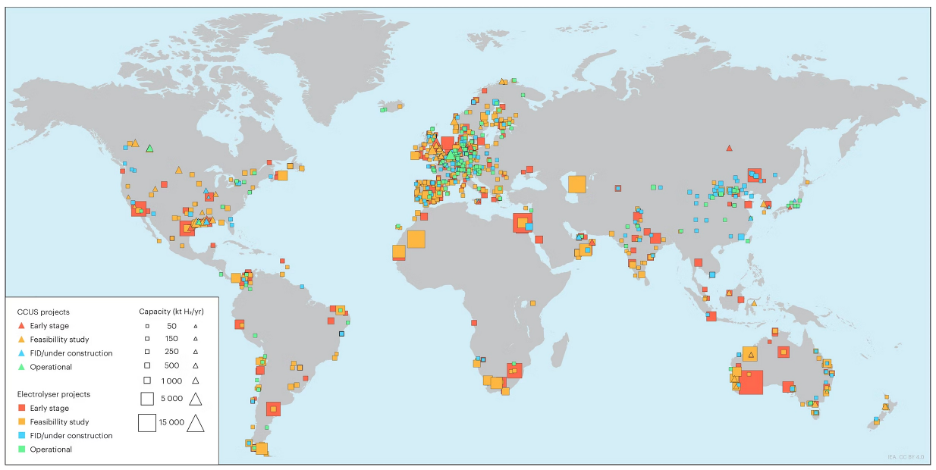

Green hydrogen is made through the electrolysis of water, using renewable electricity to split water into hydrogen and oxygen. Electrolysis is a proven and preferred low-carbon hydrogen technology globally, but about 1/3 of projects in development today are working on blue hydrogen with largely unproven CCUS. Only a fraction of these announced projects have reached a final investment decision, though, and few have started construction or operation (see figure).

Clean Hydrogen in Canada

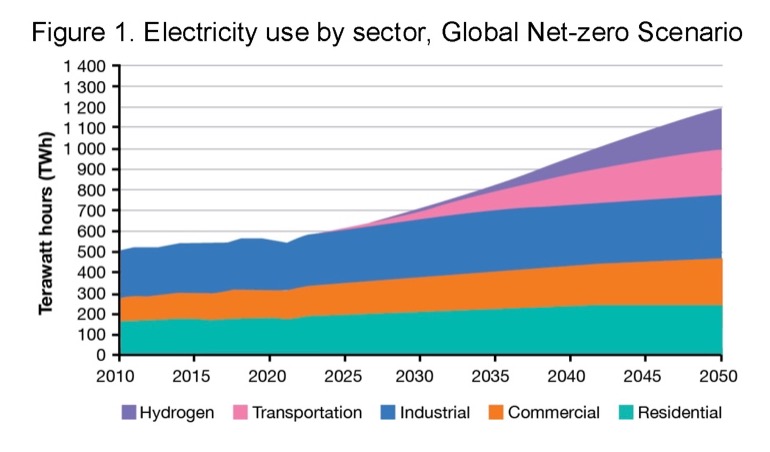

Canada’s Hydrogen Strategy (2020) sees hydrogen delivering some 30% of our energy by 2050, in a $50 billion industry employing 350,000 people. If Canada’s net-zero-by-2050 ambitions are to be achieved, electrolysers will likely become one of our biggest electricity consumers (see figure).

Bloomberg ranked Canada fourth in “hydrogen progress” in 2023, after Germany, the USA, and Japan, reflecting not only our hydrogen ambitions, but also assessing hydrogen supply, relevant infrastructure, market demand, and industry and safety standards. It also reflects the roots of Canada’s hydrogen sector. One Ontario family business, now Hydrogen Optimized, has been producing electrolysers since the 1920s; fuel cell powerhouse Ballard began operating in Vancouver in the 1990s; and Air Liquide’s 20 MW hydroelectric-powered electrolyser at Bécancour, QC was, briefly, the world’s largest green hydrogen facility.

Green hydrogen relies on green electricity, and our grid is dominated by hydroelectric and nuclear, with a solid share from solar and wind power; still, the use of fossil fuels for electricity generates around 9% of our nation’s GHGs, so there is still a big opportunity for renewables to replace coal, oil and gas.

But with more renewables we’ll need more capacity to manage variable solar and wind output. Ideally, green hydrogen will be produced with excess power at times of high renewable output, while (among other uses) fuel cells or turbines could turn hydrogen back into electricity when output is low. Hydrogen could thus help stabilize the grid while enabling more renewables to replace fossil fuels.

But several challenges remain before hydrogen can seriously interrupt our carbon-based economy.

- Green hydrogen costs remain high relative to grey hydrogen.

- Hydrogen’s low density and ease of escape make large-scale storage and transport expensive or impractical.

- Storage and distribution infrastructure is virtually non-existent.

- Manufacturing and experienced labour are limited.

- Off-take markets are undeveloped, so producers have few outlets to sell their product.

- International standards and low-carbon qualifying thresholds are not harmonized, hindering export prospects.

- Hydrogen’s efficiency is often low compared to alternatives; regenerating electricity, for example, entails losses of 50% or more.

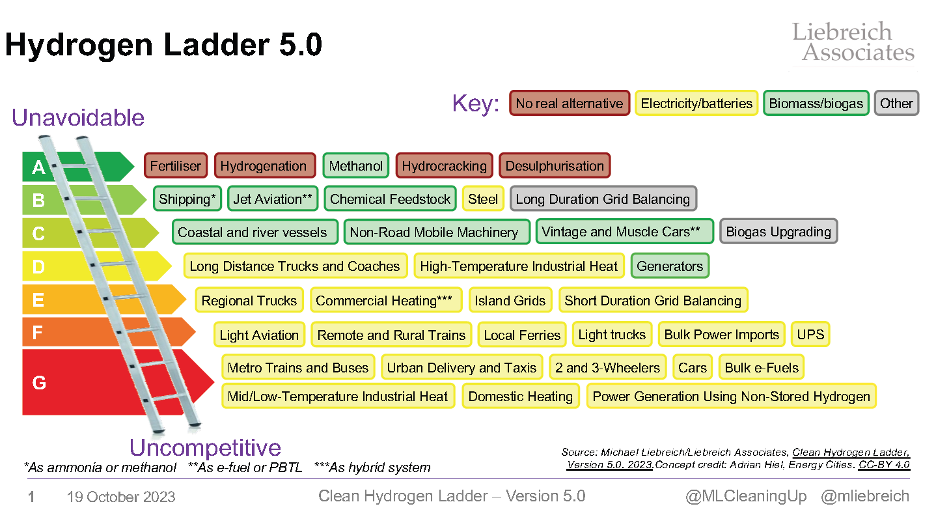

- Many favoured uses are likely better served by batteries and bio-fuels, as Leibriech’s Hydrogen Ladder suggests (see figure).

These challenges have long hampered the growth of hydrogen, but the needle is shifting as energy security and climate concerns drive intensive research and policy efforts. Europe is aiming for ten million tonnes a year of production and as much again in imports, backed with billions of Euros through a central auction house led by a European Hydrogen Bank. Canada has wooed Europe into a “green alliance” targeting hydrogen and critical minerals, but interest is global, as is the competition.

Strengthening the case for green hydrogen is the price of green electricity, which is below that of any other newly built electricity generation. Meanwhile commitments from governments and the private sector require large-scale decarbonisation of polluting technologies that hydrogen can help achieve. Innovations in technologies, policies, and industrial strategies, including the international growth of regional “Hydrogen Valleys” or “Hubs” (including several in Canada), can help bridge production and users. Promising markets are emerging, including green steel and chemical manufacturing, and new e-fuel demands like ammonia-powered shipping.

A Critical Role for Governments

The Federal Government can help Canadian companies grasp these opportunities, and has already announced over $17 billion in relevant tax credits between now and 2035. These include a Clean Hydrogen investment tax credit that will refund 15 to 40 percent of eligible investments, with projects producing the cleanest hydrogen receiving the most support. But details are scarce and clarity is needed, soon, on how these ITCs, along with new Clean Fuel Regulations, will impact the sector. The durability of the supports is critical, since large project timelines stretch over many electoral cycles.

Federal policies also need to recognize the specific circumstances of the provinces. Alberta’s hydrogen strategy, not surprisingly, focuses on fossil-based hydrogen with CCUS as a nod to the oil and gas sector. Alberta currently hosts Canada’s only functioning CCUS project, which will help determine if the technology can work at scale to reduce carbon pollution or if, as some suggest, it might make emissions worse.

“Federal policies also need to recognize the specific circumstances of the provinces”

Rob Stein

Alberta, BC, and the Maritime Provinces are also looking at exports of hydrogen and derivatives like ammonia and methanol. Ontario is exploring the use of hydrogen to provide grid services; discussion on an “interruptible rate” for hydrogen generation is stalled, however, by uncertainty around the clean hydrogen ITC.

Financing the Hydrogen Turn

Major investments will be needed in coming decades into hydrogen manufacturing, transport, and storage infrastructure, and various new end uses. In addition to tax credits, demand-side incentives like accelerated depreciation, clean fuel mandates, and price supports could help make new hydrogen-based ventures into solid investments.

Still, many parts of the value chain need to happen together, because risks are linked to the success of the entire chain. Without a steady supply, novel end-use applications cannot get going. Without solid offtake markets, investment into production and transport is unlikely. And neither manufacturing, infrastructure, nor offtake markets will be built overnight.

This chicken-and-egg problem is not going to be solved quickly, and clean hydrogen needs to build on what solid ground it has while avoiding wasted efforts. One potential “no regrets” opportunity is in replacing grey hydrogen in chemicals and refining with low-carbon sources. These sectors are large enough to solve the offtake problem for many years, enabling a gradual build-out of infrastructure while other end-uses are developed and tested.