VIDEO: Clean50 Expert Panel Makes Exceptionally Strong Case for Government Support of the Clean Tech and Renewables Industries

The CoronaVirus pandemic worldwide has created both significant risks and remarkable opportunities for Canadian companies, and some of those are particularly acute for smaller and / or newer companies that comprise our growing clean tech sector. With a global market demand for Clean Tech expected to top $26 Trillion by 2030 (Canada’s 2017 GDP is just $1.7 Trillion) and a long term world-wide decline in oil demand and prices, a misstep in this market now could be just disastrous for Canada’s future prosperity.

Now more than ever, it’s critical that our governments play a role in supporting these industries of the future – or risk Canada’s ability to compete in the growing low carbon economy of the future.

Our expert panel tackles the issues – both the risks and the remarkable opportunities.

Watch the panel’s great conversation here and for more information and some back up numbers, read below.

Some of the risks of Covid are obvious: shut downs, decreased demand, and revenues stalled to zero. In younger, growing companies already hungry for cash, and lack any reserves it can bring a quick and painful end. Other risks to Canada are less obvious immediately: Those financial hits make Canadian clean tech companies with great products – but no revenue – highly vulnerable to foreign takeovers. And if the takeovers happen, that means both the jobs and the intellectual property can easily end up somewhere else – and Canada will be buyers instead of suppliers of those products. This has already happened since March.

The opposite is also true: Our companies’ foreign competitors are also cash strapped. Meaning that with enough new investment, our clean tech companies could swoop in, aquire / eliminate a competitor, capture their IP, and move the jobs and the future export capacity to Canada.

Which would be best? How do we take advantage? The panel discusses in much more detail, led by Canada’s leader in clean tech venture capital, Andrée-Lise Méthot.

And what’s the single fastest – and most capital efficient – way to put Canadians back to work – in a safe environment? And that wouldn’t cost the government a penny in the long run?

A $1 billion investment by governments in the form of a declining subsidy / incentive to building operators or property owners who install solar energy would rapidly attract $4 billion in matching investment. Half of that combined $5 billion in captial would go to creating 50,000 jobs paying an average of $50,000 each, and all of which would be taxable as income.

And then, in turn, get spent on food, rent, entertainment, contractors, groceries etc. – each dollar cycling through the economy – on average – 3.5 times. Most of which would also be taxable…

The other half of the $5 billion – $2.5 billion – would go to buying the project materials: solar panels from Canadian distributors, aluminum racking, wire, fasteners, and controls – much of it manufactured here. A good chunk of that will also cycle through the economy 3.5 times. And all of which would be GST / HST taxable.

Net, the government’s initial $1 Billion investment would be repaid from income and consumption taxes within two years! *

And here’s the add on bonus: the solar energy would produce enough clean electricity to power all the homes in Ottawa for the next 25 years with power costing just 10 cents per kWh, displacing electricity from a variety of less clean sources and helping us drop our GHGs. In contrast, Ontario’s nuclear plants are already looking for 50% more than that: 15 cents per kWh – and that’s before the cost overruns we know are coming.

And let’s compare that to what you get from a billion dollar investment in the fossil fuel industry. On average, according to StatsCan, just 2.7 jobs per $million dollars – or 2,700 jobs per $billion. That’s 47,300 more jobs in clean renewable energy production – jobs that can be spread right across the country – and rapidly – with a good number of those 50,000 total jobs outside roles where risk of COVID spread is greatly reduced.

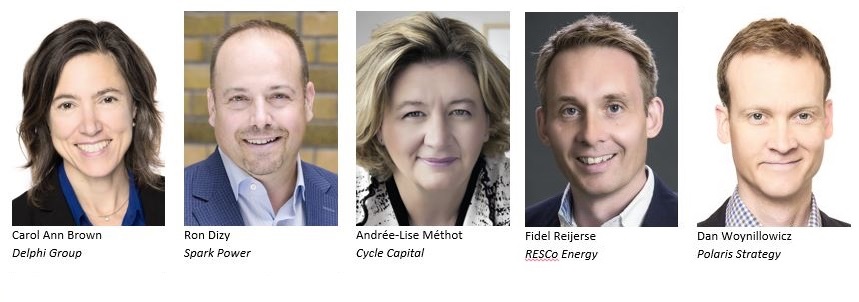

Want to hear more about how we do this? Tune in to the Clean50 CleanReset Expert Panel focused on Renewable Energy & Clean Tech featuring:

- Ron Dizy, Chief Commercial Officer, Spark Power

- Fidel Reijerse, President, RESCo Energy

- Andrée-Lise Méthot, Founder and Managing Partner, Cycle Capital

- Carol Ann Brown, VP, Delphi Group

- Dan Woynillowicz, Principle, Polaris Strategy

With moderator

- Gavin Pitchford, CEO Delta Management Group and Executive Director, Canada’s Clean50

engaging in a hugely informative discussion that discusses the incredible impact on jobs and the economy the Canadian government might have by investing in our Renewable Energy & Clean Tech industries.

The panel lays out the numbers – describes the smart ways to get rapid results – and also lays out the time critical elements needed to preserve existing jobs under stress by the ongoing COVID crisis.

This recording is part of the Canada’s Clean50 CleanReset series.

Critical support in funding, coordinating, hosting and recording the series came from The Trottier Family Foundation, The Ivey Foundation, Delta Management Group, HP Canada, Bullfrog Energy and SparkPower, Intact Insurance and Frank Cowan Company, the University of Windsor, Sustainalytics, Cycle Capital, Resco Energy, GreenEnergy Futures, Delphi Group and GlobeSeries, Clean Energy Canada, Smart Prosperity Canada, and the Pembina Institute.

*The Calculations:

It is a rule of thumb amongst solar array developers that on average, almost exactly 50% of the cost of an array goes to labour costs, and the balance goes to materials. Meaning 2.5 Billion to fund 50,000 jobs @ 50K each, and 2.5 Billion to pay for the “stuff”.

Government income calculation as follows: According to Neeuvo’s tax calculator: “If you make $50,000 a year living in the region of Ontario, Canada, you will be taxed $11,254. That means that your net pay will be $38,746 per year, or $3,229 per month. Your average tax rate is 22.51% and your marginal tax rate is 35.26%. 50,000 jobs at an average of $50,000 per person produces taxes to both levels of government of $11,254 per person – a total of $562,700,000. in the first year of employment alone.

HST in Ontario is 13%, and when paid on the $2.5 billion in materials returns $325 million to governments in taxes.

Combined, a $1 billion dollar incentive plan that is properly designed and creates a total of $4 billion in additional investment, will generate tax revenues to provincial and federal governments totalling $887,700,000 in the first year alone, before considering the “knock on effect”.

The knock on effect considers that beyond the initial spend, 50,000 employees with net income of $38,746. per year will in turn spend virtually all of it: This means $1.9 Billion dollars spent on housing, food, transportation, birthday gifts, restaurant meals, Tim Hortons’ coffee – in the process supporting thousands of additional workers, and paying $millions and $millions in additional GST / HST and income taxes.

Also consider the $2.5 billion spent on the materials to build the solar installations: Some flows out of the country via distributors and importers for some (most) of the panels themselves, (although expanding this industry would undoubtedly encourage Canadian manufacturers to get back into the game – especially in Quebec where excess clean energy could enable the manufacture of virtually zero-carbon solar panels) but much of that $2.5 billion would still remain in Canada. Solar panels need special aluminum racking and fasteners to attach to roofs or fields, plus electrical wires, connectors, fuses and electrical panels – all of which are manufactured in Canada using Canadian steel, aluminum and copper. And all of these items are purchased from Canadian distributors, each of whom takes their share, employing hundreds of workers, and paying rent to Canadian property owners to occupy warehouses across the country.

Then there’s the corporate income taxes paid by the solar installation companies, the revenue on the energy itself which is sold back to the grid to the LDC or used to reduce the building’s own energy costs (meaning more profits).

Net, for the Canadian government to invest in providing incentive to building owners and businesses to build solar arrays is a no brainer. The money all flows back to the government in a remarkably short time – it incents and drives all kinds of knock on effects across a wide variety of businesses, solar is deployable in most parts of Canada, we have a huge ability to add solar to the grid – and solar energy also provides the resilience climate change is stripping a way. An ice storm, for example, doesn’t take out power lines and then require crews days to restore power. And the energy is essentially zero emissions. Providing us with cleaner air.

This recording is part of the Canada’s Clean50 CleanReset series that explores the policy options for Canada that can drive remarkable economic opportunities in a low-carbon economy all unlocked by a post-COVID #CleanReset.

Critical support in funding, coordinating, hosting and recording the series came from The Trottier Family Foundation, The Ivey Foundation, Delta Management Group, HP Canada, Bullfrog Energy and SparkPower, Intact Insurance and Frank Cowan Company, the University of Windsor, Sustainalytics, Cycle Capital, Resco Energy, GreenEnergy Futures, Delphi Group and GlobeSeries, Clean Energy Canada and the Pembina Institute.