A Call For Improvement of Corporate Climate-Related Reporting in Canada

Sean Cleary, Chair of the Institute of Sustainable Finance and Clean50 Honouree, explains how improving the way Canadian corporations report climate-related material data is an important step in reaching 2050 Net Zero targets.

Canada’s government has ambitious targets to cut greenhouse gas emissions and get to Net Zero by 2050. And much of Canada’s emissions come from Canadian companies, either through their operations, from the production of the energy they use, or the emissions created by suppliers or customers in the company’s value chain. But we still know relatively little about the sources and the amounts of these emissions. And we can’t fight what we can’t see.

And so, very soon, Canada will decide how we will mandate the disclosure of climate-related material data by corporations. It is vital to get this right, and to continue to work toward improving the breadth, quality and accessibility of climate-related data in the future. Not only our capacity to tackle climate change, but the future of the country’s competitiveness is at stake. That includes the ability of our businesses to attract global capital, and to manage the risks and seize the opportunities of the transition to a net-zero world.

We have heard this loud and clear from Canadian capital providers. We have seen a rare joint call for better disclosures by Canada’s eight largest pension funds, collectively responsible for more than $1.6-trillion in assets. And last year, the country’s 10 largest pension funds issued a similar joint statement in response to the U.S. Securities and Exchange Commission’s request for input.

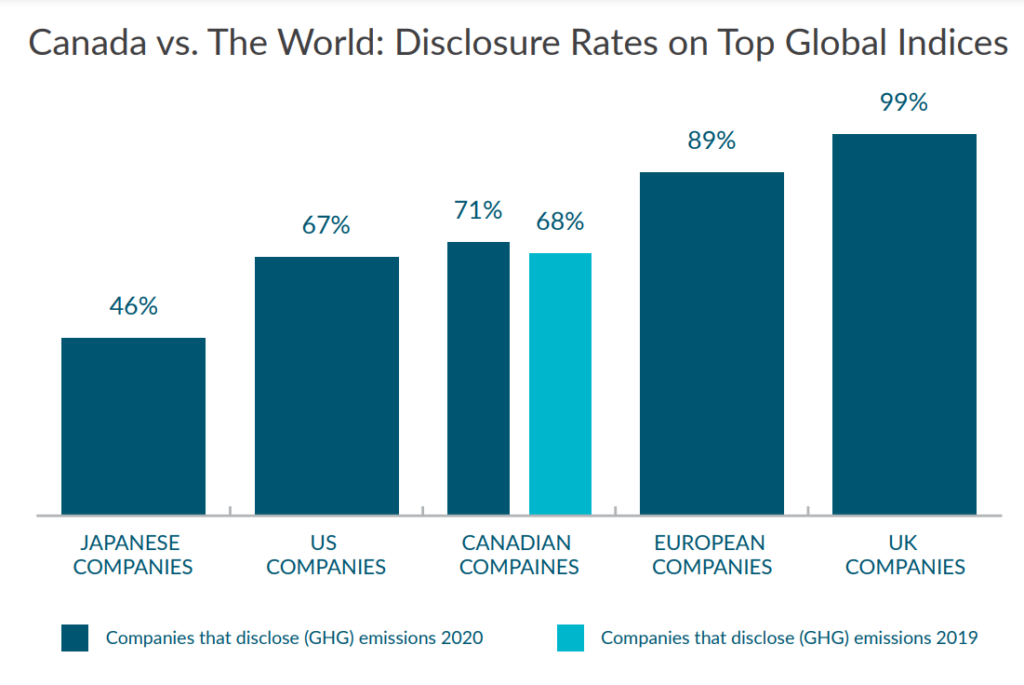

And, while we are lagging competitors in Europe for example, Corporate Canada seems to be getting the message. The Institute for Sustainable Finance’s research on the emissions disclosures and GHG reduction targets of publicly listed companies in Canada shows that 71% of firms included in the S&P/TSX Composite Index report on their emissions, and the number that have established GHG reduction targets doubled from 2019 to 2020 (from 60 to 120).

The ISF’s report also estimates that 30% of the emissions associated with all TSX Index firms would be eliminated by 2030 if only the top 32 emitting firms with stated emissions reductions targets meet them, with 121.5 million fewer tonnes of CO2 entering the atmosphere. Such a reduction would go a long way to helping Canada achieve its stated target for emissions reductions of 40% by 2030 relative to 2005 levels.

This progress on both disclosures and target setting has been largely voluntary to date; although many companies have responded to the messages they have heard loud and clear from capital providers and other company stakeholders. More recently, Canadian and global bodies are preparing to introduce regulations to require companies to disclose their emissions.

Here in Canada, there was a major development nearly a year ago. Canadian Securities Administrators (CSA) announced proposed new rules for companies’ climate-related disclosures, and there have been similar developments in Britain, the United States, European Union and other jurisdictions.

The CSA’s proposal was a much-needed step and certainly included components that will improve the completeness, consistency and comparability of climate-related financial disclosures, including implementing a significant portion of the recommendations of the international Task Force on Climate-Related Financial Disclosures (TCFD). Making such disclosures a regulatory requirement in Canada is central to achieving these objectives, and we need to act quickly.

However, as I pointed out in a Globe and Mail op-ed with my colleague Jim Leech, and as the ISF’s submission to the CSA comment process argued, we saw gaps in the proposed rules that could cost us this opportunity. Some important amendments need to be made to the CSA’s proposed regulations.

In the coming months, the CSA is expected to revisit these disclosure requirements following extensive consultations. Let’s hope that the CSA will follow the ISF’s advice, and also a global trend to tighter requirements, led by recent proposals advanced by the International Sustainability Standards Board and the Securities Exchange Commission in the US, and align with these initiatives.

Ensuring appropriate ESG and climate-related disclosure requirements that are in line with global standards represents a critical piece of [the green economy] transition

Sean Cleary

More broadly, where do we go from here? Recent ISF research points to several key areas for improvement in climate-related reporting in Canada. These include:

- The need to improve the breadth of climate-related reporting in Canada. Less than half of the largest corporations provide meaningful climate-related reports, and beyond the largest corporations such reporting barely exists at all.

- Improve the quality of climate-related reporting, which is mediocre on average among the companies that do provide such information.

- Ensure that reporting is in line with global standards, so as not to disadvantage both our capital providers, and the companies themselves that require capital at favorable market prices to prosper and remain competitive.

- Improve the accessibility to the data which does exist.

- Address issues regarding the education and leadership that illustrate the importance of such disclosures, with an increased emphasis on best practices.

- Improve both the quantity and quality of scenario analysis, which provides critical information to both capital providers and disclosing companies (with respect to their strategies and risk management processes).

- Address additional information gaps including the data provided by smaller public companies, private companies, municipalities, etc.

The solutions to the issues noted above are complex, but manageable if approached cooperatively, with clarity of intention, and with strong regulatory leadership and support. These solutions include:

- Effective and comprehensive regulation that provides globally consistent standards and makes reporting to such standards mandatory. Such an approach will go a long way to directly addressing limitations number 1 through 3 above, as well as numbers 4 and 6.

- Improve the availability and accessibility of such data. This includes improving both the quantity and quality of data that is provided, as well as improving access to data that already exists.

- Provide improved education and leadership regarding the importance and purpose for providers and users of climate-related data.

There is every reason to believe that Canada can position itself to thrive during this massive economic transition that’s already well under way. But there is plenty of work to be done and some important decisions to get right to make that happen. Ensuring appropriate ESG and climate-related disclosure requirements that are in line with global standards represents a critical piece of this transition, as noted by Mark Carney and others that initiated the creation of the TCFD framework over five years ago.