How can climate finance support the energy transition towards a global low carbon economy?

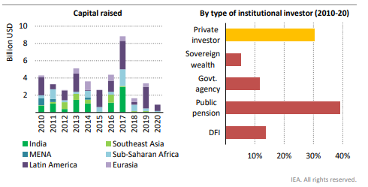

According to the International Energy Association (IEA), an unprecedented increase in clean energy funding is required to ensure the developing world is on a path towards a low carbon economy. Clean50 Emerging Leader Faith Edem from ECCC explains how climate finance can be effectively deployed to help developing countries improve their ability to respond and develop country specific mitigation, adaptation and biodiversity action.

To effectively finance the clean energy transition, the IEA recommends that towards the end of the 2020s, the annual investments allocated towards clean energy in developing economies will need to expand by more than seven times: to above USD 1 trillion, to put the world on track to reach global climate commitments such as net-zero emissions by 2050. The United Nations Framework Convention on Climate Change (UNFCCC) uses a key principle in addressing our relationship with climate change: common but differentiated responsibilities. This concept demands for all actors to contribute to climate action.

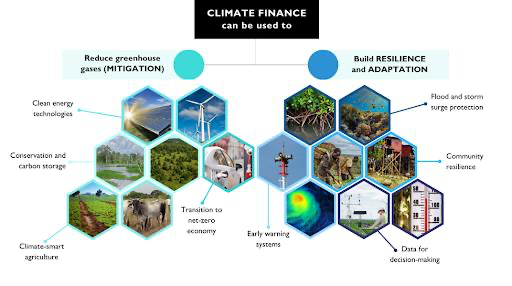

It is apparent that each developing country will face their own set of climate specific challenges. Across the board, developing countries experience fundamental challenges in developing and sustaining domestic low carbon economies. Developing countries are disproportionally impacted and experience challenges such as limited infrastructure, lack of investments, limited institutional capacity, lack of access to international partners, infrastructure barriers or simply a lack of economy-wide coordination on national determined contributions (NDC). The objective of climate finance is to identify opportunities to address these climate action gaps that developing countries will need to achieve their Paris targets.

Governments utilize a toolbox of policies, regulations, and commitments to combat climate change. To support climate action, transformative financial investments are needed to help countries around the world adapt to climate change. Mobilizing climate finance through all sources such as south-south cooperation, philanthropic and non-governmental organizations, and the private sector puts developing countries on a path forward. The energy transition will require ambitious climate finance commitments to support the transition towards a low carbon economy.

According to the UNFCCC, climate finance refers to local, national, or transnational financing, drawn from public, private and alternative sources of financing that seeks to support mitigation and adaptation actions that will address climate change. These funds are intended to reduce emissions and enhance adaptation and mitigation action to maintain and increase the resilience of human and ecological systems to negative climate change impacts.

All developing countries are not eligible recipients of climate finance; only countries that have been identified as Official Development Assistance (ODA) eligible can be recipients of climate finance development support. According to the Organization for Economic Cooperation and Development (OECD), the list of ODA eligible countries consists of all low- and middle-income countries, small island developing states and Least Developed Countries (LDCs).

Climate investments are one of many solutions used to target economy-wide action for developing countries. The United Nation has highlighted that climate finance, when sustainably invested with committed leaders, can lead to a path of climate justice. As developed countries have recognized the vulnerabilities that developing countries experience, the commitment to mobilizing finance scales up the the climate ambition of developing economies.

In 2021, at the G7 Leaders Summit, Canada committed to doubling its international climate finance commitment from $2.6 billion to $5.3 billion over 2021-2026. In 2009, at COP15, developed countries collectively committed to mobilizing US$100 billion each year towards international climate finance to support developing countries and small island states to reduce their emissions.

The global commitments to mobilize $100 billion in funds to assist developing countries to achieve their Paris targets supports collaborative action by providing opportunities for leveraging public and private impact. To support ambitious climate action, fostering an enabling environment for private partnerships creates opportunities for further collaboration on climate action. Climate leaders in the private sector have available to them a range of global commitments and initiatives such as the Global Methane Hub, The Green Climate Fund, Global Biodiversity Framework’s 30 x 30 target, Loss and Damage Fund and other commitments available to explore to leverage additional investments towards climate action.

According to the IEA, the opportunity cost of reducing emissions in developing economies on average is estimated to be around half the level in advanced economies, creating a cost-effective pathway to combat climate change. These opportunities increase as low carbon technologies and services continue to move across borders to support the global energy transition.

As we know, private partners are responsible to their board and stakeholders. It is imperative that enabling environments are developed to support the low carbon economy, as it provides the opportunity for private partners to leverage additional funding that aligns with their private sector interests while increasing the profile of their role as key actors in the transition to the low carbon economy.

In efforts to reduce the tragedy of the commons, where resources from the environment are unsustainably misused and poorly allocated, all partners will need to play their part in common but differentiated responsibilities. By spurring collaborative initiatives, the responsibility does not fall to one actor, but rather all participating actors are responsible for doing their part in the fight against climate change. This is how climate finance can be leveraged through collective accountability, incentivized environments for low carbon solutions, and the commitment of key actors towards funding allocation.

The type of funding developing countries have access to when climate finance is not available is limited as foreign investors tend to only invest in industries and countries that can support a low carbon market and do not pose potential risks to their investments either through policy, regulations, or business practices. As entrepreneurs in developing countries seek opportunities for investments, there is an opportunity gap that public financing and private funds climate can fill.

It is through targeted program development for climate finance that developed countries can allocate a portion of their international funding towards projects that support developing countries and small island states in addressing their climate change priorities. It is through sustainable and cost-effective investment that the energy transition can provide the appropriate support developing countries will need to meet their Paris targets. By mobilizing collective financial investments towards climate action, developed countries can create enabling conditions for ambitious partnerships and provide opportunities to leverage additional funds to support the transition to a low carbon economy.