How Financial Intervention Can Drive the Low-Carbon Transition

Fossil fuel extraction and use must halt in order to achieve rapid emissions reductions. However, without addressing the largest fossil fuel firms and divesting from fossil fuel financing, countries will not meet the globally accepted 2-degree target. Truzaar Dordi, Clean50 Honouree, explains how financial intervention can make or break the transition away from fossil fuels.

To simply understand fossil fuels as a source of energy would be a disservice; fossil fuels are agents of cultural change. Like water to fish, fossil fuels are essential but unnoticed, pervading all aspects of life. The industry’s political, economic, and cultural influence may thus be one of the greatest barriers to achieving the rapid emissions reductions required to limit warming under the globally accepted 2-degree target.

The world’s largest fossil fuel firms, colloquially known as the Carbon Underground 200, can alone cripple global efforts toward the low-carbon energy transition. Collectively, these 200 oil, gas, and coal firms own 98 percent of global fossil fuel reserves and have the potential to generate an additional 674 gigatons of carbon emissions; 20 times greater than global emissions in 2019 and 3 times greater than our global carbon budget. Consequently, we cannot meet our global climate commitments without addressing the Carbon Underground 200.

The call for action is clear – the vast majority of existing fossil fuel reserves must remain in the ground. Operationalizing this goal, however, is challenging – industrial economies remain deeply locked into fossil-fuel-based systems of production. Legal structures (like counterproductive subsidy programs), social customs (such as dependence on automobiles) and institutional interests (such as risk-averse lending practices) build feedbacks that inhibit changes to incumbent systems and exacerbate lock-in conditions.

What is urgently needed are high-leverage interventions that limit the production and expansion of the fossil fuel industry. However, state mitigation strategies alone have proven to be ineffective in deterring fossil fuel combustion. Consequently, novel forms of non-state interventions from the non-governmental and private sectors have been critical in climate change mitigation efforts.

One key group of actors that are frequently overlooked in climate discourse are capital markets. Through the mobilization of critical financial resources, capital markets can play a central role in enabling or hindering the low carbon transition.

“Capital markets present a critical intervention point to enable a low-carbon transition. Without their engagement, we simply won’t have what it takes to meet our emissions targets and avoid climate catastrophe.”

Truzaar Dordi

Mapping the influence of capital markets

Though traditionally ambivalent, capital markets can take an active role in enabling a low-carbon transition in the fossil fuel industry – not only by shifting capital away from carbon-intensive firms and toward low-carbon alternatives but by wielding its influence within the industry through shareholder engagement. Certainly, capital markets have historically been foundational in supporting economic and sociotechnical transitions and will be vital once again in a low-carbon transition.

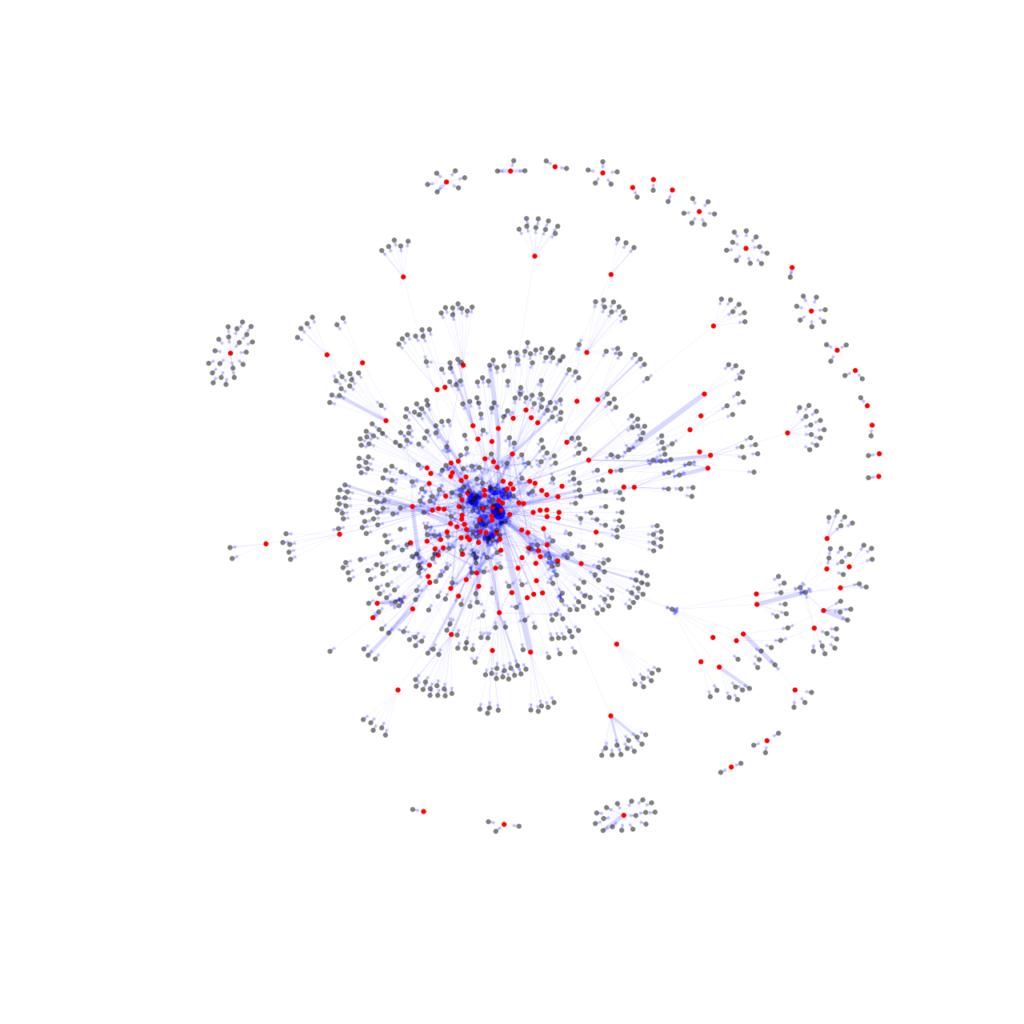

Yet, financial actors may differ in influence, and thus, effective points of intervention may also differ. Through a global partnership with researchers from the University of Waterloo, University of Otago, and Banque de France, we thus asked, who has the greatest potential influence over the governance of the fossil fuel industry?

Our study, now published with the Environmental Innovation and Societal Transitions Journal, maps directed ownership dynamics between the 200 largest fossil fuel firms and their 900+ shareholders. Using a novel scoring mechanism, which blends the financial actor’s influence with their emissions exposure, we find that just ten actors own 49.5% of the emissions potential from the CU200. These ten actors alone have the potential to shift the industry in a more sustainable direction.

| Target | Type | Country | Degree | Emissions | Score |

| Blackrock | Investment Advisor | United States | 0.97 | 10.14 | 9.85 |

| Vanguard Group | Investment Advisor | United States | 1.00 | 8.86 | 8.86 |

| Government of India | Government | India | 0.04 | 68.23 | 2.57 |

| State Street Corp | Investment Advisor | United States | 0.45 | 2.25 | 1.02 |

| Kingdom of Saudi Arabia | Government | Saudi Arabia | 0.01 | 104.21 | 0.98 |

| Dimensional Fund Advisors | Investment Advisor | United States | 0.43 | 1.94 | 0.84 |

| Life Insurance Corporation | Government | India | 0.06 | 11.60 | 0.66 |

| Norges Bank | Sovereign Wealth Fund | Norway | 0.54 | 1.14 | 0.61 |

| Fidelity Investments | Investment Advisor | United States | 0.41 | 1.46 | 0.59 |

| Capital Group Company | Investment Advisor | United States | 0.24 | 1.99 | 0.47 |

The study also finds that sizable power to reduce emissions resides in the domestic activity base, and countries like the United States, Canada, China, and Japan should be leading decarbonization efforts domestically. Investors are more likely to engage and succeed in engagement efforts when the target firm is domestic.

The results not only assert that financial markets can influence the trajectory of sustainability transitions, but also exemplify that power is concentrated among just a handful of powerful and path-dependent financiers.

Moving in the right direction

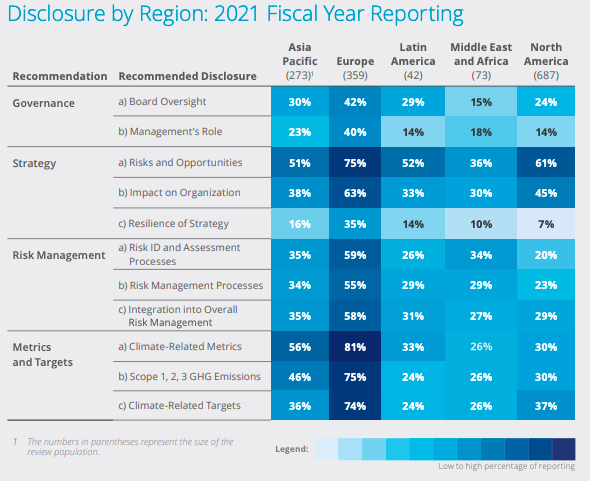

The call for action is ambitious but feasible with concerted action. Capital markets, through their ability to mobilize necessary resources, may be particularly influential in enabling a low-carbon transition. Existing owners can mandate an assessment of a portfolio’s exposure to climate risk in a 2°C world and an alignment of investment portfolios with a 1.5°C scenario. Beneficiaries can demand public disclosure of a scheduled phase-out of fossil fuel financing.

The uptake of divestment, net-zero, and voluntary commitments like the Task Force for Climate-Related Financial Disclosure and Glasgow Sustainable Finance Alliance indicates a shift in thinking among financial actors toward a carbon-constrained future. However, the financial system may be unlikely to sustain the transformative changes that are necessary to respond to the climate crisis unless it is disciplined to do so.

Capital markets present a critical intervention point to enable a low-carbon transition. Without their engagement, we simply won’t have what it takes to meet our emissions targets and avoid climate catastrophe. Consequently, we posit that financial actors that maintain holdings in fossil fuel firms and don’t wield their influence to enable a low-carbon transition should be held accountable for propagating climate instability.