A Call to Action: The Importance of Deploying Home Flood Protection as Costs of Extreme Weather Continue to Rise

Kathryn Bakos, recipient of an Emerging Leader Award, on why home flood resiliency is key as the effects of climate change create adverse financial impacts for the homeowners in our communities.

With climate disasters constantly hitting the headlines, including deadly heat waves, and catastrophic wildfires and flooding, it is impossible to ignore the growing risk of extreme weather events.

What’s more, even if we manage to significantly reduce greenhouse gas emissions now (which is imperative), disastrous extremes will continue for centuries, if not millennia, to come. Individuals, communities, businesses and governments therefore need to prepare for these changes.

The consequences of unpreparedness include costly damages to property, disruption of business continuity and supply chains, global economic impacts, violent conflicts, and loss of life.

“…an all-of-society effort to protect a home owners investment from the growing threat of flooding would be of great benefit…”

Kathryn Bakos, B.Sc., MEB

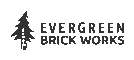

According to the Insurance Bureau of Canada, the average yearly catastrophic insurable losses (e.g., extreme weather events such as floods, wildfire, etc. that trigger more than $25 million in insurable losses) in Canada have risen to around $2 billion; a marked increase compared to the period between 1983 and 2008 when losses averaged $422 million a year (Figure 1).

Other trends contributing to the upward curve include the loss of climate resilience provided by natural habitats, such as wetlands and forests, aging public infrastructure and the fact that past construction did not consider a changing climate.

A large portion of insurable losses are due to water-related damage. More specifically, these losses are manifesting in the form of flooded basements. For most homeowners, their house is their biggest financial investment. A key question relevant to homeowners, government, and business is: how do losses from basement flooding impact the Canadian housing market?

To answer this question, the Intact Centre on Climate Adaptation (Intact Centre) conducted the study, “Treading Water: Impact of Catastrophic Flooding on Canada’s Housing Market” to examine whether catastrophic flooding affects Canadian residential real estate (house sold price, days on market, number of listings) and mortgage markets (arrears and deferrals).

The analysis of the data for this report was not difficult but obtaining the data was quite problematic, as there is a systematic lack of centrally located publicly available data reporting the impact of climate change on housing markets throughout Canada. More specifically, our team could not obtain housing data directly through any national or provincial associations – we quite literally thought this research project was “dead in the water”.

Through teamwork and critical thinking, our team worked to engage real estate agents active in specific communities across Canada who were able to (1) secure housing data required from local real estate boards and (2) have intimate knowledge of the specific communities and street-level data that would be required to obtain information for flooded and control communities. Our team developed relationships with these individual real estate brokers and depended on these agents to secure the required data – this process took nearly a year.

Once our team secured and analyzed the data, findings showed that between 2009-2020, catastrophic flooding in communities resulted in an average 8.2% reduction in the final sold price of houses, 44.3% reduction in the number of houses listed for sale, and 19.8% more days on market to sell a house.

For context, a house that would sell at the Canadian average price of approximately $630,000 (as of August 2022), could be discounted to approximately $578,000. This would reflect a “flood discount” (and not in a positive sense) of approximately $52,000, which is equivalent to leaving a high-end vehicle such as a BMW, Audi or Mercedes on your driveway to be washed away in a storm.

The 44.3% reduction in average houses listed for sale was hypothesized to be because of a (1) expectation of a lower listing price in the aftermath of flooding, (2) waiting for the “stigma” of flooding to pass, and/or (3) time required to remediate a house following flood damage prior to listing.

The 19.8% increase in average days on market to sell a house may not be as material to homeowners as houses still sold but the additional 13 days, on top of the average 65 days (December 2021), to sell a house in Canada could compound stress during an already stressful time.

The study also examined the impact of community level flooding on mortgage arrears and deferrals in two Canadian cities for six months pre and post flooding. Results showed no change in homeowners’ ability to pay their mortgage, but a reduction in the appraised value of a house due to flooding would influence limits on lending by mortgage providers.

Recognizing that residential flooding is the most costly and pervasive impact of extreme weather, the report findings bridge the gap between climate change impacts and financial data to bring decision-useful insights to homeowners, communities, governments and businesses.

The data alone is not enough to actively increase resilience and reduce flood risk. The key is deploying resilience measures to limit the impact of flooding at the community and/or individual house level.

The question became, are measures available to address flood risk?

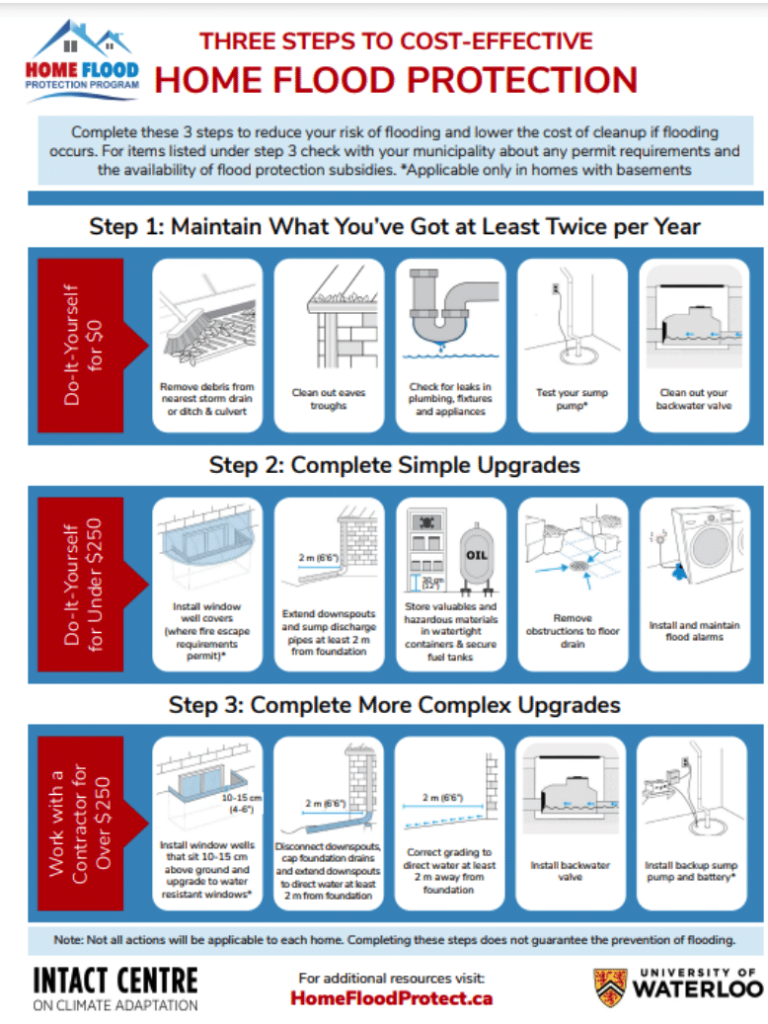

The good news is that actions are available to help homeowners limit flood risk. At the top of the list, the “Three Steps to Cost-Effective Home Flood Protection” infographic (Figure 2) provides Canadians with a summary of the top actions residents can take to reduce home flood risk.

As the results of the report clearly show, an all-of-society effort to protect a home owners investment from the growing threat of flooding would be of great benefit to many Canadians.

The Intact Centre has worked to deploy the home flood protection infographic to thousands of real estate and mortgage brokers, real estate agents, home inspectors and appraisers, mortgage customers, volunteers and communities across Canada. And yet, this information must continue to be distributed to reduce risk.

This is a call to action for all communities and business such as municipalities, banks, insurers and real estate associations to share, promote and distribute guidance to home owners, employees, customers, etc. on means to lower risk of basement flooding through home flood protection guidance.

Basement flooding is the biggest financial cost of climate change for homeowners and the “Three Steps to Cost-Effective Home Flood Protection” infographic is a big part of the solution!