Hydrogen and Its Future Economic Role

Hydrogen is deemed more efficient than traditional and renewable energy sources, but its production, mostly reliant on fossil fuels, remains emissions-intensive. The global perspective highlights increasing hydrogen projects, particularly in Asia, while North America, with significant hydrogen demand, is positioned for leadership in low-emission production and clean-tech innovation.

On Earth, hydrogen is the most abundant chemical element and can be produced from a variety of resources, including water and renewable energy; having the potential to play a significant role in the global energy mix over the next 20 years.

Types of Hydrogen

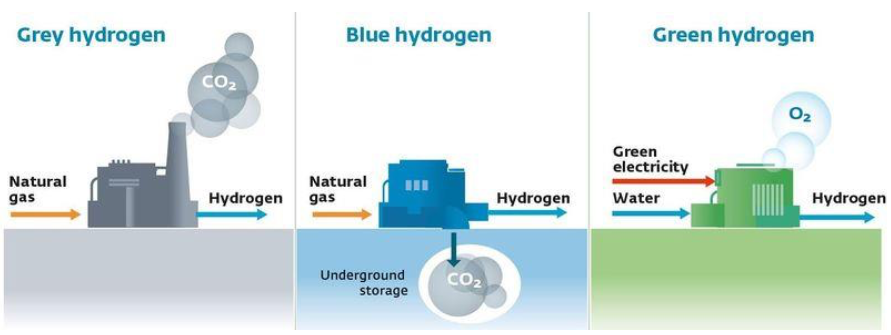

Hydrogen can be produced from a variety of different feedstocks – including natural gas, nuclear power, biomass, and renewable energy and in a variety of different ways. The process of creating hydrogen fuel varies and can include thermal processes where steam reforming is used to cause hydrocarbon fuels (natural gas, diesel, gasified coal, etc.) to produce hydrogen under extreme heat, and electrolytic processes where water is separated to create oxygen and hydrogen, among other methods . In today’s market grey, blue, and green hydrogen are the most discussed.

Grey Hydrogen: Hydrogen produced using fossil fuels (natural gas and coal for example); today, this is the main type of hydrogen produced globally. During the thermal production process, carbon dioxide (CO2) is created and released into the atmosphere. This type of hydrogen is a high carbon fuel.

Blue Hydrogen: Following the same production process as grey hydrogen, with the requirement that most of the CO2 created is sequestered/stored underground. Because of this, blue hydrogen can be considered a low-carbon fuel relying on fossil fuels as a key input.

Green Hydrogen: Producing green hydrogen requires clean energy to be used as the electricity source during its production. This type of hydrogen is considered low/zero-emission as it relies on sources of energy which do not release greenhouse gas (GHG) emissions during electricity generation and typically relies on electrolytic processes. Although a low-carbon fuel option, its production can be quite costly.

Hydrogen in Today’s Economy

In 2022, the demand for hydrogen hit an all-time high with its use increasing by nearly 3% year-over-year (an equivalent of 95 Mt in 2022) mainly through grey hydrogen use in traditional applications such as refining and industry. In today’s market, the application of hydrogen is progressing – including its use within steel projects and in rail fuel cells, although progression for low-emitting hydrogen has been slower – accounting for under 1% of total hydrogen demand in 2022 as per the International Energy Agency (IEA). That said, although most hydrogen being used to date is high-emitting, government action has been largely focused on progressing and supporting the production of low-emitting hydrogen. To reach Net Zero emissions by 2050, it is estimated that low-emitting hydrogen use will need to grow by 6% annually until the end of the decade. As per the IEA, the creation of supply and demand by government and corporate entities will play a vital role in the success of low-emitting hydrogen and its scalability.

How Does Hydrogen Compare to Other Energy Alternatives?

Hydrogen is a more efficient and reliable alternative when compared between traditional and renewable energy sources. It is more energy dense than fossil fuels – meaning that, for applications like motor vehicles, a smaller quantity of hydrogen is required to power an engine than gasoline or diesel (1 kg of hydrogen contains roughly 3 times more energy than 1 kg of gasoline). Additionally, for electricity generation, hydrogen is less affected by weather and seasonality compared to both wind and solar.

“Hydrogen is a more efficient and reliable alternative when compared between traditional and renewable energy sources”

Rebecca Francolini

Despite hydrogen’s benefits, as mentioned previously, much of its production today relies on fossil fuels and thus remains highly emissions intensive. To transition hydrogen towards its “lower carbon” state, the capacity to capture and store carbon must be increased as does the availability/sourcing of renewable energy for its production. Because of this, facilitating investment in low-emitting hydrogen will also require further investment in other innovation clean technology (CCUS, industrial ports, renewable electricity, etc.). As demand for renewable energy continues to ramp up, it is expected that the production cost for green hydrogen will decrease although grey hydrogen remains the least costly and highest emitting option to date (emitting ~4 times more g of CO2e/kWh when comparing high-end estimates of coal gasification versus solar produced hydrogen). This strengthens the argument that society could benefit from the introduction of low-carbon hydrogen to help. meet global emission reduction goals, albeit doing so may be challenging.

Hydrogen: A Global Perspective

In 2022, over half of the world’s hydrogen electrolyzers were installed in Asia and the potential global use of

hydrogen has continued to increase. With policy being a driver of recent enthusiasm, we are seeing an increased

presence of hydrogen within government and company strategies, and budgets across the globe as shown 7

below. Funding for hydrogen, including subsidies, remains particularly significant in France, Korea, Germany and Japan relative to GDP. That said, the momentum for clean hydrogen is quickly growing. To date, over 500 global hydrogen projects, worth over $500 billion in investment, have been announced and over $130 trillion in private capital has been committed to transform the economy to a low-carbon one. As of 2021, the potential average annual funding available for hydrogen projects out to 2030 is vast.

Hydrogen: A North American Perspective

Over the past few years, Canada and the United States have highlighted the importance of funneling resources and investment into clean energy alternatives in achieving decarbonization. Canada and the United States remain among the top producers and consumers of hydrogen globally – with the US accounting for around 13% of global hydrogen demand, and Canada’s domestic hydrogen industry being projected to have an above $50 billion annual projected value up to 2050. With North America’s high reliance and exposure to fossil fuel production, Canada and the US are in a unique position to be leaders in low-emitting hydrogen production and clean-tech innovation – making clean hydrogen scalable, while taking advantage of current workforce, infrastructure, geology, and R&D capabilities.

“Canada and the US are in a unique position to be leaders in low-emitting hydrogen production and clean-tech innovation”

Rebecca Francolini

Hydrogen: An Investment Opportunity

Today, many political and economic changes are taking place across the global energy landscape, all of which are needed to support the global decarbonization of hard-to-abate industries and sectors such as steelmaking, shipping, and road haulage among others. Hydrogen will be pivotal in this shift, as it offers a cross-cutting technology to help sectors such as clean power, transportation, buildings & industry, and agriculture to transition and thrive in a low-carbon economy. This highlights how clean hydrogen cannot be considered in isolation from energy use and clean technology & innovation, and instead needs to be considered as a broader part of the energy transition and the economy.

References

Hydrogen Fuel Basics | Department of Energy

Global Hydrogen Review 2023 (windows.net)

Frequently Asked Questions about Commercial Hydrogen Vehicle Refueling (nist.gov)

Global Hydrogen Review 2022 (windows.net)

The Future of Hydrogen (windows.net)

Action on clean hydrogen is needed to deliver net-zero by 2050 | World Economic Forum (weforum.org)

These countries could become world leaders in clean hydrogen | World Economic Forum (weforum.org)