Investing in Carbon: The Trade of Our Time

Lenka Martinek, Managing Partner at Nordiis Capital discusses how regulated carbon markets, combine environmental impact with investment potential. Offering inflation protection and low correlation to other assets, these markets are poised for growth as economic activity rebounds, weather normalizes, and negative sentiment diminishes in 2025.

It has been well over a decade since the inception of the first carbon markets in North America, and the concept of buying and selling emission credits is no longer novel: putting a price on carbon via regulated markets like Quebec’s cap and trade system is potentially one of the most powerful tools for curbing emissions.

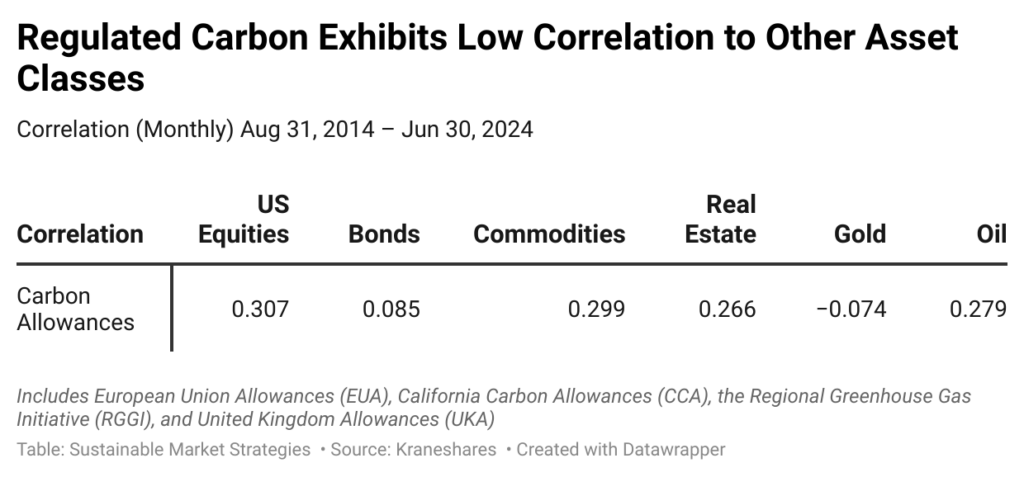

But regulated carbon markets have also proven themselves to be a liquid and investable asset class; over $1 billion per day is traded across physical carbon, futures and options and investor demand regularly accounts for about 20% of all winning auction bids in North American regulated carbon markets. No wonder: the asset class offers investors two important financial properties: a potential to protect against inflation and low correlation to other investments.

Regulated Carbon: What Is It

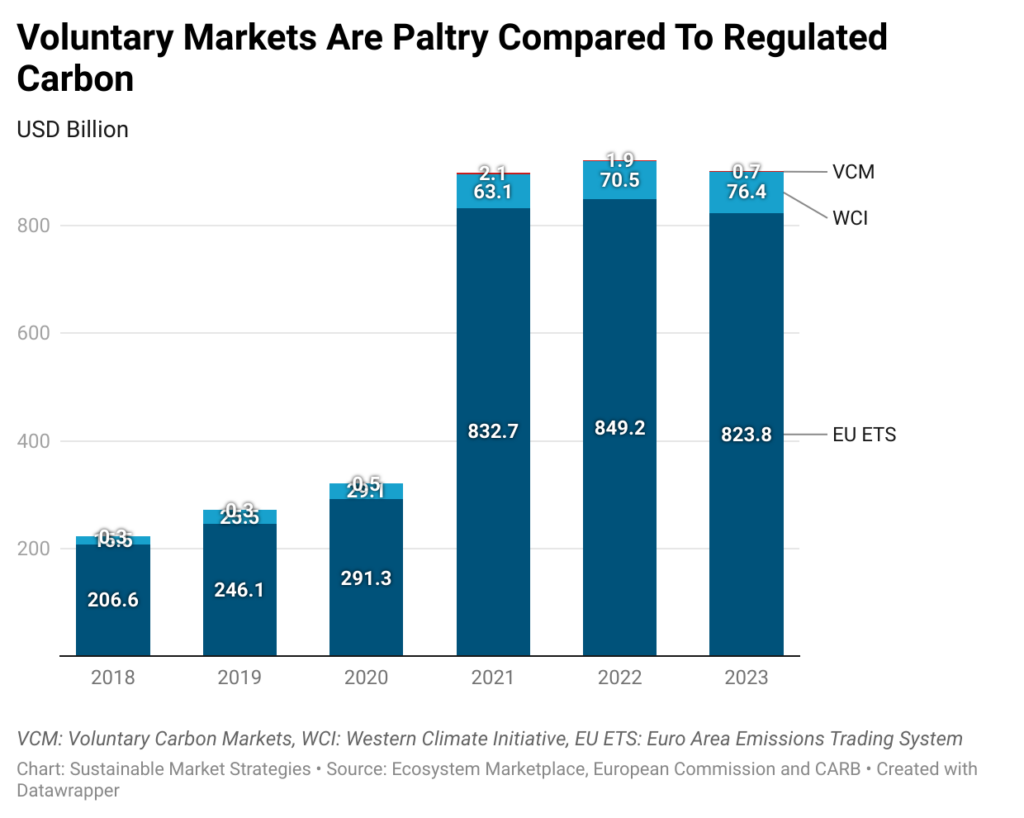

Two kinds of tradeable carbon markets exist. The first is carbon allowances, which are credits issued by governments in cap-and-trade systems, i.e. regulated carbon. The second is the voluntary carbon market, on which carbon offsets are bought directly from project developers or brokers/intermediaries and are intended to balance an entity’s carbon footprint by investing in projects that reduce or remove emissions.

As is becoming well-known, the quality of carbon offsets, i.e. the voluntary market, is extremely heterogeneous and is fraught with risk, due to their unregulated nature. The value of the voluntary carbon market has dropped significantly, due to reputational and credibility problems and for all the talk.

Conversely, existing regulated carbon markets are already well-functioning, liquid and of a high standard. For these reasons, we believe that investors should focus here.

Long-term Factors of Regulated Carbon Price Moves

Regulated carbon markets are cap-and-trade systems that set emissions limits for specific industries, including oil and gas production, transportation, electricity distribution utilities, and large industrial facilities. Funds raised through auctions are then used to finance the development of low carbon economic activities.

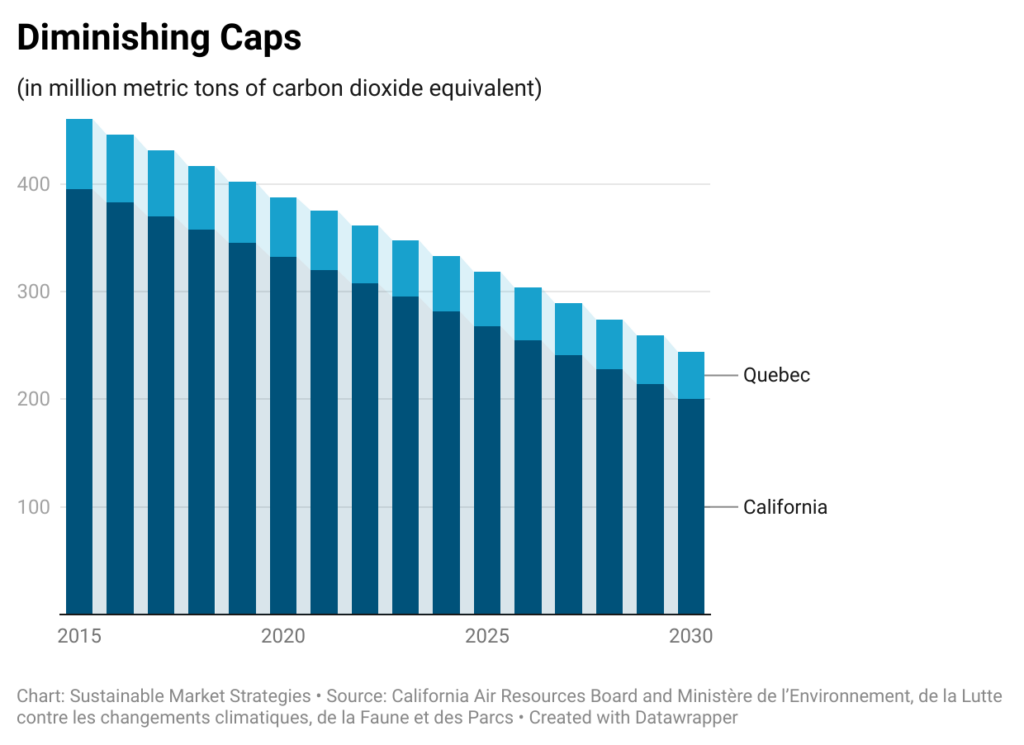

The main feature of regulated carbon markets is that they are intended to create scarcity for the right to emit carbon and this scarcity intensifies over time via a decreasing cap. For example, in the California system, the distribution of allowances is set to be reduced by one-third in 2030 from its 2021 level.

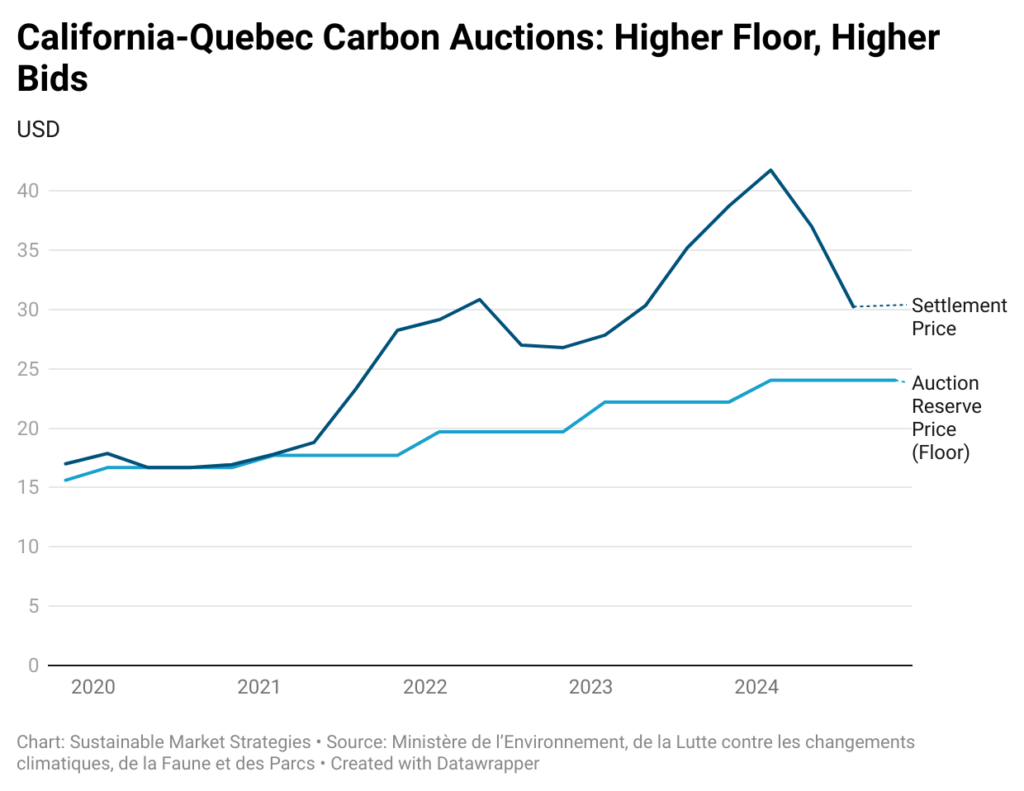

In addition, in most cap-and-trade systems, the floor price, i.e. the minimum price at which a carbon allowance may trade hands, increases each year by law. These two factors – scarcity by design and minimum pricing – means that there is a strong likelihood that carbon prices within the system will increase over time.

“The main feature of regulated carbon markets is that they are intended to create scarcity for the right to emit carbon and this scarcity intensifies over time via a decreasing cap”

-Lenka Martinek

Short-term Factors of Regulated Carbon Price Moves

Like all traded financial instruments, the price of carbon in various cap and trade systems has not moved up in a straight line. Traded carbon allowances are subject to the basic laws of supply and demand and the following factors tend to affect the underlying price on a cyclical basis:

- Industrial demand: Cap and trade systems cover the largest emitting sectors, including the utilities and industrial sectors that are highly correlated with swings in economic activity. When economic output is strong, more carbon emissions are produced and hence more allowances need to be purchased, i.e positively impacting demand and putting upward pressure on prices.

- Weather patterns: in some jurisdictions like California, weather patterns can influence the demand side. Periods of drought force utilities to switch from hydroelectricity production to production of electricity from natural gas. The latter requires utility companies to purchase additional carbon allowances, once again putting upward pressure on carbon prices.

- Regulation: As with any market that is dependent on government intervention, a change in the regulatory backdrop can create price volatility. Political pressure can force lawmakers to alter the pace of carbon allowance removal, and therefore change market participants’ expectations about the price of credits.

- Knock-on effect from other markets: As described above, the voluntary market has come under quite a bit of scrutiny during the past eighteen months. However, just as “risk on” trades tend to be tightly correlated despite often having different underlying drivers, there can be contagion between sentiment regarding voluntary carbon offsets and regulated carbon.

The Current Investment Opportunity

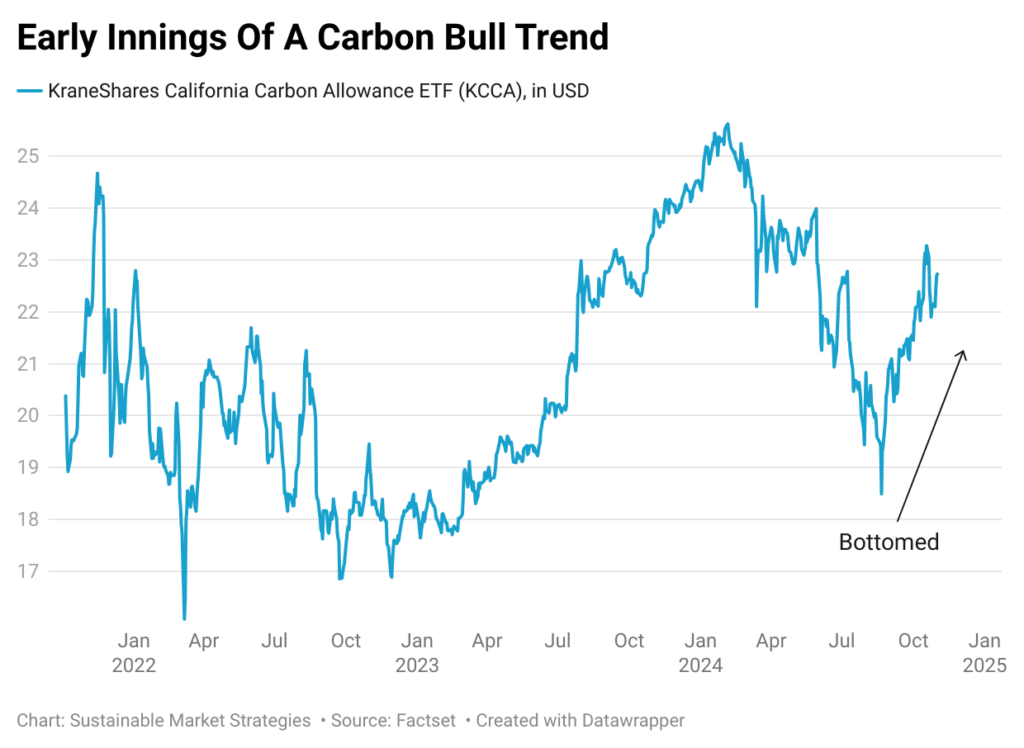

Over the past year, all the four factors described above worked as headwinds in the California-Quebec cap-and-trade (i.e. the main North American) system:

- Manufacturing output has stagnated throughout 2023 and 2024, decreasing the need for enterprises within the cap-and-trade system to purchase credits.

- California rainfall has been above average more recently, and annual hydropower generation has increased significantly, which has reduced the need for utility companies to purchase carbon offsets.

- A significant negative shock to the Quebec-California carbon price came this past July when regulators announced that they would delay by one year the implementation of its updated regulations. In practical terms, stiffer carbon allowances will only be in place beginning in 2026 rather than 2025, effectively delaying the creation of scarcity.

- It is hard to quantify the knock-on effect from the decline in popularity of voluntary offsets. However, 2023 was a disastrous year for the voluntary programs as scandal after scandal rocked the market. Surely this adversely impacted the budding interest from financial players in regulated markets as well.

Looking ahead, the bulk of the bad news for North American regulated carbon is behind us and developments are increasingly positive. For one, there is an increasing effort to standardize voluntary offsets with the objective of making them safer for investor, which should stem any negative sentiment contagion emanating from the voluntary market.

Although guessing the weather should not be an investment strategy, simply assuming a return to the mean, i.e. that the 2024-2025 season does not yet again deliver record rainfall, would mean that weather conditions would be less of a drag on carbon prices over the next several quarterly auctions.

Finally, industrial activity in the U.S. has turned a corner, with key indicators like the ISM manufacturing survey trending higher.

Pulling it all together, of the four major factors that are affecting North American carbon prices in the near term, the majority are turning from headwind to tailwind, creating enticing conditions for higher carbon prices in 2025.

“Looking ahead, the bulk of the bad news for North American regulated carbon is behind us and developments are increasingly positive”

-Lenka Martinek

Why and How to Invest in Carbon

Investing in regulated carbon markets offer investors two important financial properties: a potential to protect against inflation and low correlation to other investments.

- Inflation protection: in the California-Quebec cap-and-trade system, the minimum price (or floor price) increases each year by a set amount plus the annual rate of inflation.

- Uncorrelated to other markets: As discussed above, carbon prices are somewhat positively correlated to the business cycle given that the demand for carbon credits increases when economic activity is accelerating. However, given all the other factors involved, carbon prices tend to have a beta less than one and importantly, display low correlation to other financial assets (see the table below).

As such, we believe regulated carbon markets should occupy a growing place in investors’ asset allocation: for those looking for attractive financial characteristics as well as real-world impact, participating in regulated carbon markets is the way forward.