Methane Dilemma: Canada’s Oil & Gas Sector Emissions

Liz O’Connell, Co-Founder and President of Arolytics, discusses methane emissions in the oil and gas sector and highlights Canada’s significant progress in reducing these emissions to-date.

Despite the emergence of renewable energy sources, responsibly produced oil and gas is expected to remain an important element of the global energy supply for decades to come. An important aspect of responsibly produced oil and gas is reducing the intensity of greenhouse gas (GHG) emissions that arise from production, such as carbon dioxide and more importantly, methane gas. Methane, which is 80 times more powerful than carbon dioxide, is typically the primary component of natural gas. In order to reduce its destructive effects during the transition to renewables, methane must be quantified, located, and mitigated when possible. This poses a significant challenge as methane is colourless and odourless and has the potential to emit from millions of point-sources across the oil and gas supply chain.

“A methane leakage rate over 3% during natural gas production negates the climate benefits of gas over other energy sources, including coal.”

The increasing demand for verifiable methane data in the energy sector impacts an energy company’s license to operate, access to capital, and overall market performance. To understand the scale of this problem, approximately 3.6 trillion cubic feet of natural gas escaped into the atmosphere from global oil and gas operations in 2012, which translates into $30 billion of lost revenue and significant greenhouse gas emissions globally (Climate & Clean Air Coalition, 2019).

Canada’s Regulatory Landscape

In 2018, Canadian leaders committed to reducing methane emissions from oil and gas production by 45%, and last year, a new 75% reduction target was announced that is expected to be finalized in 2024. To reach these targets, new regulations implemented require oil and gas companies, for the first time ever, to directly measure methane emissions from hundreds of thousands of wells and facilities 1-4 times per year as of 2020. This act is called ‘leak detection and repair’, or LDAR.

Canada is a global leader in methane regulations, having enforced one of the first widespread LDAR programs across the oil and gas industry. Other countries are quick to follow, notably at the Federal EPA level in the U.S., in which regulations are set to come into effect in late 2023, creating an approximately 6 times increase in data and reporting requirements for the U.S. oil and gas sector.

Why LDAR?

As a result, emissions management is a rapidly expanding and evolving market. With new regulations that require companies to measure and report emissions, there has been a flood of new sensor technology into the market. More specifically in North America alone, over 150 new sensors and vendor solutions are deployed via continuous sensors, hand-held sensors, vehicle-based, UAV, aerial, or satellite platforms. Oil and gas companies are having issues evaluating technology types, cost effectiveness, and accuracy of data, to understand the best emissions monitoring and management strategy for their unique assets and production type.

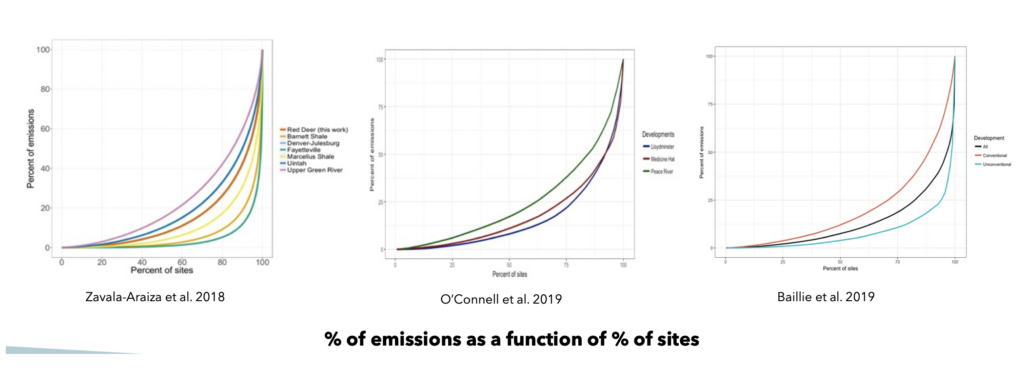

Emissions across broad populations of oil and gas facilities generally form a heavy tail distribution, in which 10-20% of facilities are responsible for 70-90% of emissions. For effective management, it is critical to focus efforts on the large leaks.

Once the leaks are detected, they must be repaired. Depending on the cause of the leak, the repair can be simple (tightening a connection), or complex (requiring a complete shut-down of a facility). LDAR can be applied across the supply chain—to upstream activities including well development, gathering, and processing, as well as to downstream activities such as transmission or distribution lines.

Methane abatement costs vary, and typically depend on the frequency of leak detection surveys, the severity of the leaks, and the technologies used for methane emission detection and mitigation. Additionally, the cost of LDAR depends on the type of equipment or facility being inspected—surveying a complex facility for methane leaks can take much longer than surveying a well-head. In general, more frequent leak detection surveys cost more and lead to fewer methane emissions; however, the rate of return of frequent LDAR programs eventually begins to decrease, and the point at which this happens depends on how frequently new leaks appear. The leak production rate tends to differ for every regulatory jurisdiction, producer, and production style.

Detecting and measuring methane emissions in a comprehensive and cost-effective manner remains a fundamental challenge because there is a wide variety of methane detection technologies and methods available.

“Creating the perfect LDAR program that reduces emissions while keeping costs low can be a difficult task.”

Liz O’Connell

While many companies already undertake LDAR, the practices and rigour of programs vary widely. Regulation can standardize practices by dictating options for detection methods, a timetable for repairing leaks based on their severity, and requirements for detailed record-keeping and reporting of leaking components. Maintaining detailed records of leaking equipment is important as analysis of records can reveal opportunities to implement early maintenance practices for leak prevention in problem areas.

Efforts are being made to incentivize the deployment of these abatement technologies via voluntary and regulatory means. Where reduced emissions do not pay for themselves, or where barriers prevent companies from taking action that would otherwise be cost-effective, policy and regulatory interventions may serve to encourage companies to take steps to reduce their emissions.

The difficulty in accurately quantifying methane emissions from leaks poses a challenge to other potential policy approaches, such as market-based or performance standards, which rely on strong emissions quantification. While a number of technologies already exist to detect, measure, and abate methane emissions, this is still a dynamic area with new technologies emerging. As such, it is important that policy and regulatory approaches can adapt to advances in technology so that regulatory requirements do not become a barrier to methane abatement. A well-designed regulatory scheme can allow for improvements in technology, or even provide incentives for companies to seek innovative solutions.

To Summarize

Strong emissions performance is a competitive differentiator. During this energy transition period, oil and gas producers are demonstrating that they are taking strong action to reduce methane emissions in order to credibly argue that their resources should be preferred over higher-emission alternatives. With the help of progressive regulation, most of the oil and gas methane emissions could be avoided, as long as a variety of mitigation efforts—including LDAR—continue to be deployed.

For more information on global methane levels, see the International Energy Agency Global Methane Tracker: https://www.iea.org/data-and-statistics/data-tools/methane-tracker.