Net Zero Future: Mobilizing Private Capital in Public Markets

Bernard Tan, CEO of RE Royalties, illustrates the importance of increasing climate investments through public markets to ensure we meet our climate goals.

“Invest in our Planet”.

The urgency of this call to action has never been greater, in light of the increasing evidence of climate change. Heat domes. Atmospheric rivers. Unseasonal wildfires. Dried up rivers. Decade long droughts. Storm surges. Once in a century floods. The Polar vortex.

These “once-in-a lifetime” events are becoming ever increasingly common and defines the new normal where climate change is affecting all aspects of our modern society. We have seen how these weather events damage critical infrastructure, cause frequent disruptions to supply chains, and reduce food production across the globe. This has inevitably stirred economic inflation, increase the risk of famine and drought, create economic damage across the globe and instigate geopolitical disputes.

“This year’s theme for Earth Day: ‘Invest in our Planet'”.

Bernard Tan

Governments, policy makers and capital markets across the globe continue to pour astronomical sums of resources and capital to fight against this incoming tide of climate change.

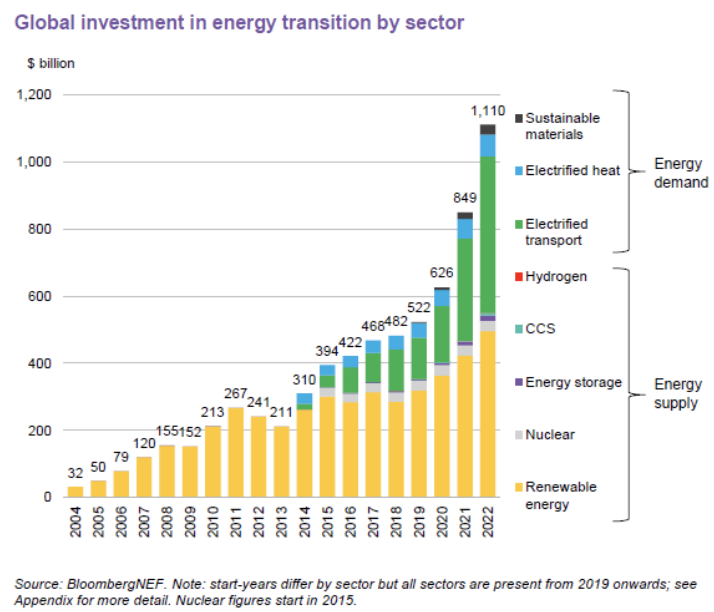

According to BloombergNEF, over $1.1 trillion was invested into the low-carbon energy transition in 2022. This investment trend has been on a fairly steady increase 18 of the past 20 years.

Despite the large amount of capital pouring in over the past few years, researchers, climate scientists and economists estimate that annual investments must triple for the rest of the 2020s in order to stay on track to meet global net zero ambitions.

So where can we find more capital and what can be done to help further help accelerate more climate investments?

The public markets.

According to research conducted and tracked annually by BloombergNEF, climate investments through the public markets, consisting primarily of either initial public offerings or secondary offerings have lagged behind the overall climate investment trend. For instance, in 2022, only 4.6% of the $1.1 trillion came from the public markets.

Furthermore, when looking at Canadian data provided by the TMX Group, the results are similar.

At the end of 2022, there were 95 publicly traded clean technology and renewable energy companies on the TSX and TSX Venture Exchange with a total market capitalization of approximately $56 billion, representing only 1.4% of the overall market capitalization of the Exchange. Furthermore, only $741 million in new capital was raised in 2022 for the renewable and cleantech sector.

By comparison, mining and financial services represented 13% and 24% of the overall market capitalization on the Exchange.

Despite this lack of representation by renewables and cleantech in the public markets, Canadian investors continue to pour money into investments that incorporate some form of ESG criteria. According to the Responsible Investment Association, a staggering $3 trillion of assets under management utilize some form of responsible investment methodology. For these AUM, the top focus for investors was to address climate change, and the top concern from investors was greenwashing.

This trend clearly demonstrates the demand by investors wanting their savings to focus on sustainability. However, if you look closely at most ESG products, there is a dearth of cleantech or renewables in their portfolio holdings.

So how do we unlock and refocus this demand by investors on climate investing given the small ecosystem of cleantech and renewable publicly traded companies?

First, we need a platform for publicly traded cleantech and renewable energy companies to grow that ecosystem and bring greater awareness directly to investors.

The idea behind the inaugural Canadian Climate Investor Conference occurring in Toronto on June 8 was to create that platform for growth oriented companies to share how their businesses are contributing to the energy transition, helping investors earn attractive returns, and helping reduce the impacts of climate change.

The conference takes a market-oriented approach towards publicly traded climate investments designed to help democratize the ability for individual investors to participate in growing the clean economy and to accelerate the deployment of capital required for a net-zero future.

Second, some clear and pragmatic solutions were proposed in 2019 by an expert panel in sustainable finance. This expert panel, chaired by Tiff Macklem, now the Governor of the Bank of Canada, and consisting of some of the top finance minds in Canada, made certain recommendations to the federal government on how to mobilize private capital, spur sustainable growth and address climate change.

Within this report contained several recommendations to help connect the dots between Canada’s climate objectives, economic ambitions and investment imperatives, and to propose solutions on how to mobilize capital from the private sector to build a sustainable and resilient economy for the future.

These recommendations focused on utilizing tax and investment incentives within the tax code to catalyze private capital to invest in the green economy, specifically the (1) expansion of registered savings plans for climate conscious products, (2) use of tax credits for investors, and (3) tax exemptions for green bond investors.

Before diving into these recommendations, historically, the use of targeted tax and investment incentives have proven to be very successful in catalyzing, building and supporting various industries in Canada. For example, the principal residence tax exemption and first time homebuyer incentive are essential in encouraging home ownership formation. The scientific research and experimental development (“SRED”) tax credit and various provincial venture capital tax credits provide critical investment incentives for technology and biotechnology investors. Flow-through programs mobilize risk capital for the mining and oil & gas sectors. Accelerated depreciation tax credits motivate manufacturing companies to invest in new equipment.

Even registered plans such as RRSPs and TFSAs encourage individuals to save for their retirement and provide a way to supplement their CPP. These targeted incentives do not require direct government funding and is a smart and effective way of directing needed capital into creating employment and building industries.

1. Expansion of registered savings plans

Recommendation 2.1 of report encouraged government to “create a financial incentive for Canadians to invest in accredited climate-conscious products through their registered savings plans.” Specifically, the panel recommended the program provide: (i) taxable income deductions greater than 100% on eligible contributions combined with (ii) an extended fixed-dollar contribution limit for accredited climate conscious investments.

2. Use of tax credits for investors

Recommendation 9.2(b) of the report also further encouraged the use of tax credits, whereby bond investors would receive tax credits in place of interest payments so that issuers do not have to pay a full market interest rate on their green bonds.

3. Tax exemption for green bond investors

The report also recommended the consideration for tax exemptions to green bond investors, where investors would not pay income tax on interest from the green bonds that they hold.

Adoption of these recommendations would incentivize Canadian investors to invest in Canadian businesses that contribute to a sustainable and environmentally resilient future, while also helping improve their competitiveness.

It would in turn provide innovative companies with the necessary capital to bring their products and solutions to market, create high quality employment, enrich communities, and build sustainable ecosystems. This flow of capital will supplement government efforts in ensuring we meet our climate goals on time and will not require direct government funding into the sustainable economy.

As we approach the fourth anniversary of the expert panel’s Report on Sustainable Finance, it is important that the recommendations made not be lost or further delayed within the internal bureaucracy of governments.

The climate crisis is already here and is increasingly more devastating with each passing year. Further delay on action will only exacerbate what is already an urgent situation.

Investing in our planet is an investment in ourselves, our well-being, and the well-being of all living beings. Let us seize this opportunity to make conscious choices and take decisive action to secure a thriving and resilient planet for future generations. Together, we can be the catalysts of change and shape a better, more sustainable world.