Advice from a Venture Capitalist on Taking Outside Capital

Investment in sustainability innovations and climate tech is essential for Canada’s transition to a green economy. Mike Winterfield, founder of Active Impact Investments, Canada’s largest climate tech seed fund, shares his advice for founders seeking outside investment.

“Enter at your own risk!” is perhaps the sign that should be flashing for both founders and investors the first time a company moves from being bootstrapped to taking outside capital. I am still learning but I have now been a part of nearly 60 financial transactions and try my best to help a portfolio of 27 companies. Over the last 5 years, I have experienced situations that were more stressful, complicated and inefficient than they needed to be if investors and founders had agreed to some simple ground rules before investing.

We need to take responsibility for sharing our learnings with first-time founders before we invest to make sure we are aligned. I hope that in addition to helping us and our founders, some of these may be valuable for any founder to consider before taking outside capital for the first time.

1) Investing should be a partnership.

The average investment relationship lasts longer than the average marriage and there is no easy way out for either side. Founders worry about bad investors that will be heavy-handed and tell them what to do or take control. Investors worry about bad founders that will take their money and then completely ignore their advice, even when what they are trying is failing.

I have seen founders appear very keen to get advice and admit they got themselves into a jam when they needed more money, only to immediately change the narrative and seek full autonomy to spend as they see fit as soon as the bank account is full again. I once used the example “if this was all your money, you could stand on the boardroom table and cluck like a chicken if you wanted and there wouldn’t be a single person that could tell you not to.”

On the flip side, do references on your investors with their portfolio of founders and make sure they do not have a track record of unreasonable demands. A healthy relationship is an agreement to always consider the best options together as a team and agree on a path forward.

2) You need to understand governance.

A board is not a group of advisors or even worse, cheerleaders and it is not a PR strategy to leverage a big name. A board is a group of directors with a fiduciary responsibility to always act in the best interest of the common shareholders. When I took the Directors Education Program (DEP), one line stuck with me: “it is the board’s job to hire and fire the CEO.” Fortunately it has never come to that on any board that I’m a Director on, but I have seen it happen in one of our investments.

Most new founders do not understand they report to the board and many fail to understand the mechanics of how each director is either added or removed from the board. In many cases this is not at the whim of the founder. You need to know how many of the seats you control and consider putting a term on those seats. By Series A you will certainly have at least one seat nominated by the preferred share investors and this often happens at earlier stages if you take institutional money.

3) Investors are not disposable.

It takes work to build a relationship and the best founders do a very good job of having all their current investors happy and ready to write another cheque and/or give a positive endorsement to the next round of investors. It is surprising when founders get annoyed with the investors that initially took a chance on them and try to start over fresh with a new group of investors every financing. Who do you think new investors are going to ask about your performance and attitude?

Plus, adding vs replacing goes a lot further. From my experience of watching the very best founders partner with their investors, it actually is not that hard. Be transparent about how the business is doing both good and bad and give regular updates. Dodging calls or emails is the worst thing you can do even if you are dreading sharing bad news. Keep in mind that investors have seen a lot of things and if you are willing to share the warts, they might have an idea that can help.

“…create the kind of relationship and partnership that is enjoyed by both sides.”

Mike Winterfield

4) Consider a board of advisors.

If you do not feel you are getting the right mix of experience to guide your decisions based on how your board needs to be structured for governance, then you can create another group. This group can be completely hand-picked by you to fill in any gaps you have in your leadership team. With this group you have full autonomy to decide what advice you want to take and what you want to ignore.

In essence, this group is unique from investors and board members that you are stuck with … advisors are disposable. My advice on this group is to reach up as high as you can. I am impressed by founders that look for the utmost expert in a worldwide search and get them as an advisor vs the founder that grabs the first EIR they meet at the local accelerator.

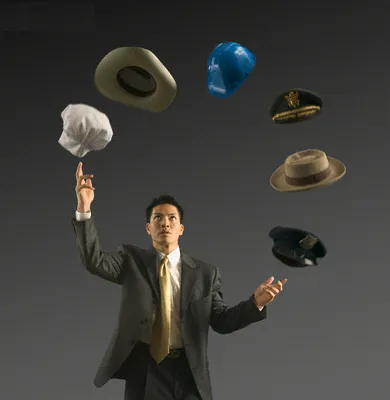

5) Multi-hat directors, investors, and advisors can be very helpful.

You need to understand which hat your director, investor, or advisor is wearing in any given conversation. As an investor, they are aligned with wanting a big share price increase and have ‘skin in the game’ which should make it easier for you to ask for their help making commercial or talent introductions. But as an investor, they may have different mechanics (rules) on the shares they own than the ones you own as a founder.

As an advisor, it’s great to get a ‘2 for 1’ where you add strong governance to your board AND you get someone with exceptional knowledge you can leverage on a functional skill or your industry. When they wear their advisor hat, they are trying to help you, not necessarily the company or common shareholders.

But please remember, when they have to wear their director hat, they do not get to decide who they are serving. At that moment, they are legally bound to serve one set of stakeholders and that is not you.

In conclusion…

I hope some of these thoughts help to generate healthy questions and conversations. Bringing in outside capital is not something that founders should take lightly at any stage in their business. It is a long-term, entrenched relationship that needs to be nurtured — with give and take, care and attention.

It is true that no one knows your business like you do but there is a purpose and advantage to taking outside money. Leverage their collective experience, show appreciation for the risks they have to manage and try to create the kind of relationship and partnership that is enjoyed by both sides.