2025 National Cleantech Industry Survey Insights

Projects Sponsor

To support Canada’s net-zero goals, Natural Resources Canada launched a national cleantech survey targeting more than 2,000 pure-play firms. Developed with industry associations across Canada, the National Cleantech Industry Survey captured over 600 responses from firms and revealed critical insights on capital, market barriers, and scaling needs. These findings now guide clean growth policy, investment, and regional development. A public report and dashboard make the data accessible to all, reshaping how the Government of Canada supports its cleantech ecosystem. By intrepidly mapping the frontline of Canada’s net-zero transition, Natural Resources Canada helps guide our net-zero journey.

The National Cleantech Industry Survey project was launched in response to a critical information gap: Canada had no reliable, nation-wide source of qualitative or quantitative data on pure-play cleantech firms. What information there was about companies whose primary mandate is the development and deployment of clean technology was anecdotal, fragmented, or buried within broader clean economy statistics. There was no unified or consistent definition of cleantech, and no national dataset that reflected the unique challenges, opportunities, or growth dynamics faced by the clean tech sector.

This posed a major barrier to evidence-based policymaking and strategic support, particularly as cleantech is a key enabler of Canada’s net-zero transition. Without firm-level data, governments and stakeholders were limited in their ability to design targeted programs, allocate funding effectively or assess the impact of clean growth strategies.

The 2025 National Cleantech Industry Survey, a Natural Resources Canada initiative, was designed to fill this gap. Their preliminary research had shown that painstaking research needed to be done.

Before launching the project, the team had conducted a comprehensive scan of over 100 existing sources that listed or referenced cleantech companies in Canada. These included industry association directories, innovation program recipients, and commercial data and research platforms such as Bloomberg or Pitchbook.

The National Cleantech Industry Survey team found that none of these sources were up to date, and most used inconsistent or vague definitions of what constitutes a cleantech company. There was no authoritative or centralized source that captured firm-level data specific to pure-play cleantech companies. The planet is faced with the fight of its life and Canada didn’t even know how many players were on our team or how many were going to make it to the game or what was holding them back.

The National Cleantech Industry Survey team found that none of these sources were up to date, and most used inconsistent or vague definitions of what constitutes a cleantech company. There was no authoritative or centralized source that captured firm-level data specific to pure-play cleantech companies. The planet is faced with the fight of its life and Canada didn’t even know how many players were on our team or how many were going to make it to the game or what was holding them back.

Recognizing the strategic importance of clean technology to Canada’s net-zero goals and economic competitiveness, the team concluded that the federal government should take the lead in becoming the authoritative source of cleantech data which would help support evidence-based policy, program design, and investment decisions.

After this initial research helped set their objectives, the team began by completing a comprehensive review of over 100 data sources to identify cleantech firms. They then validated companies that were still active and classified them according to a Government of Canada cleantech taxonomy—a rigorous methodology for identifying pure-play firms, and the creation of a national survey tool to gather standardized, comparable insights, cross-verified by Statistics Canada. This established, for the first time, a credible and consistent picture of Canada’s pure-play cleantech landscape.

This work informed the foundation of their national cleantech pure-play database. They then engaged their Expert Advisory Council, made up of regional industry associations from across Canada (e.g., Canada Cleantech Alliance, ECO Canada, Ecotech Quebec, OCTIA, Foresight) and federal partners to guide survey development, starting with a draft scope and initial survey questions in November 2024.

Through a series of consultations in December 2024, the project team refined the survey content based on feedback from industry associations and government stakeholders. By January 2025, they began testing the survey platform, initiated translations, and circulated a revised draft for final input. Following a final internal review, the survey was launched in February through targeted email outreach and coordinated promotion by NRCan and industry partners.

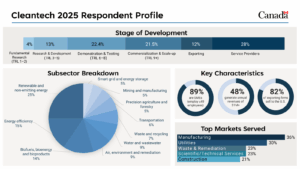

Over an 8-week period, the team conducted regular follow-ups with non-respondents, ultimately securing over 600 detailed responses. After the survey closed at the end of March, the team began data analysis and shared initial findings internally in April. Final survey products, including a public report and interactive dashboard, were prepared for public release following the federal election in Spring 2025. The products provide high-quality, accessible, and actionable insights and are now available to the public, policymakers, industry, and investors.

Building a first-of-its-kind national cleantech database required navigating uncharted territory. One of the biggest obstacles was the lack of direction that comes with creating something entirely new. There was no existing playbook for building a national, authoritative database of cleantech companies. The team had to navigate uncertainty and make foundational decisions from scratch.

Securing strong industry engagement posed a major challenge and industry associations and partners initially expressed skepticism that the team could achieve meaningful survey participation. They cited typical response rates of only 10 to 15 percent based on past experience and efforts. To address this, the team co-designed outreach strategies with these partners, prioritized clear and concise questions tied to real-world business concerns, and made the survey as simple and accessible as possible.

These efforts resulted in an impressive 25 percent response rate in the inaugural 2022 survey and a 30 percent response rate in 2025, which exceeded industry expectations.

Survey results delivered unprecedented firm-level insights into, scaling needs, barriers to capital, market diversification and non-financial support gaps. These insights are now being used by federal departments, provinces, and industry organizations to inform clean growth strategies, develop regional profiles, and align funding tools with industry realities

Survey results delivered unprecedented firm-level insights into, scaling needs, barriers to capital, market diversification and non-financial support gaps. These insights are now being used by federal departments, provinces, and industry organizations to inform clean growth strategies, develop regional profiles, and align funding tools with industry realities

The project achieved its core objective of filling a critical data gap by producing Canada’s most comprehensive dataset on-play cleantech firms. The team successfully identified over 2,000 firms and conducted a nationwide survey that received 611 completed responses. This impressive completion rate surpassed engagement expectations and established a reliable evidence base for policy and program design.

Where there was a lot of guessing, a public-facing interactive dashboard and report, hosted on the Government of Canada’s website, makes data accessible to all stakeholders. A biannual update process, ensuring the data remains current and continues to inform future decision-making.

This data has been adopted by industry associations, federal colleagues, trade commissioners, investment attraction teams, and regional economic development agencies. This is already helping support foreign direct investment, export promotion, and strategic positioning of Canada’s cleantech strengths.

By intrepidly mapping the frontline of Canada’s net-zero transition, Natural Resources Canada helps guide our net-zero journey.