AIMCo & Ontario Teachers’ Pension Plan Board: Global Sustainability Benchmark

Projects Sponsor

Before the Global Sustainability Benchmark (GRESB) Infrastructure there were no globally established tools to assess, validate, and benchmark the sustainability performance or the environmental, social and governance (ESG) risks and opportunities of infrastructure funds and assets. Anyone seeking comparable, reliable data on the ESG performance of their investments would come away disappointed. This means organizations around the globe lost out on opportunities to improve performance, or adequately quantify risk because, who knew?

After GRESB, all that has changed and the woman behind that change is Alison Schneider, AIMCo, Director, Responsible Investment. It was Ms. Schneider who chaired the original investor working group—the Global Infrastructure Sustainability Council—and designed the first survey. She also presided over the memorandum of understanding with GRESB infrastructure which was launched in the Fall of 2015, with 10 investors comprising over US1.5 trillion AUM.

GRESB Infrastructure is an on-going project undertaken with the purpose of developing a fit for purpose benchmark tool where no industry specific sustainability benchmarking tools existed. Expansion of ESG consideration across asset classes was a key goal as well as enhanced screening, due diligence and monitoring all of which inform investment analysis.

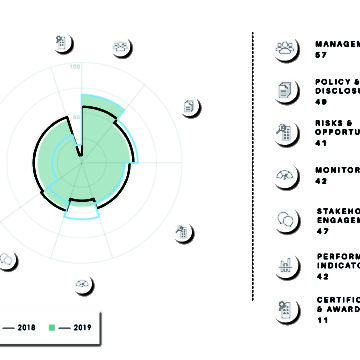

The process is

such that the assessments are guided by what the industries and investors

themselves consider to be material issues in the sustainability performance of

real asset investments and are aligned with international reporting frameworks.

Assessment participants

receive comparative business intelligence on where they stand vis-à-vis their

peers, guidance as to what actions they can take to improve their ESG

performance and a communication platform to engage with investors.

Investors use the ESG data and GRESB’s analytical tools to monitor their investments, engage with their managers, and make decisions that lead to a more sustainable real asset industry, something the world so desperately needs.

The hope was that by providing more infrastructure datapoints, the GRESB—the first truly global sustainability benchmarking tool for infrastructure assets and funds sustainability—would encourage greater sustainability practices and foster investor confidence. Ambitious as this hope was—relying as it did on internal organizational buy-in and gaining permissions to request assets and funds to fill out survey, and being able to successfully field concerns both internally and from the assets and funds themselves regarding the time required and the subsequent reporting burden to fill out the survey—Ms Schneider and her team pulled it off.

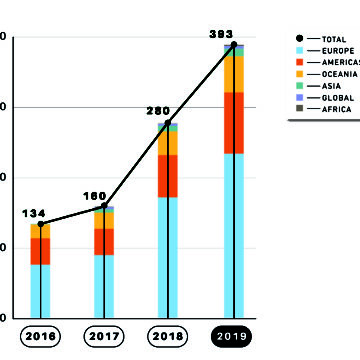

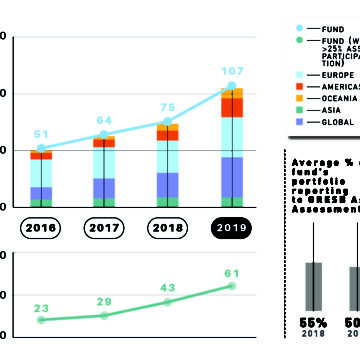

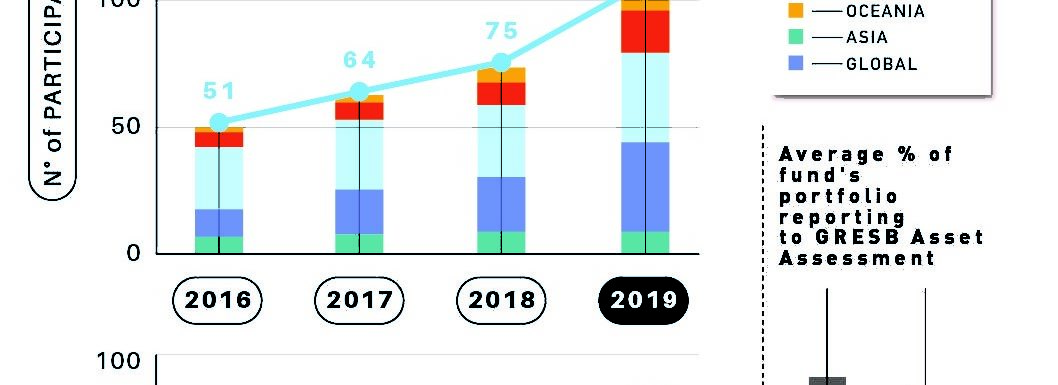

Although it was slow going at first, Ms Schneider managed to recruit investor members. The Ontario Teachers and AMP Capital came on board before the MoU with GRESB, and a couple of other investors joined right before the launch and a remarkable, and rapid, success has followed. As of 2018, the GRESB Infrastructure Assessment has 23 investors, 62 members (up from 10 original investor members) and 75 infrastructure funds, representing $100 Billion in gross asset value (GAV) responded. As well 280 assets across representing $500 Billion in gross asset value (GAV) responded and these respondents represented 62 countries across six continents and 24 infrastructure sectors.

Because the survey is dynamic and can adapt to new trends, such as demand for carbon data and climate resilience models, as well as for tracking asset and fund performance relative to the SDGS, its benefits are incalculable. Canadian institutional investors are leading the way in creating a global ESG standard that’s a game-changer in the fight against climate change.