The Net Impact Score

Projects Sponsor

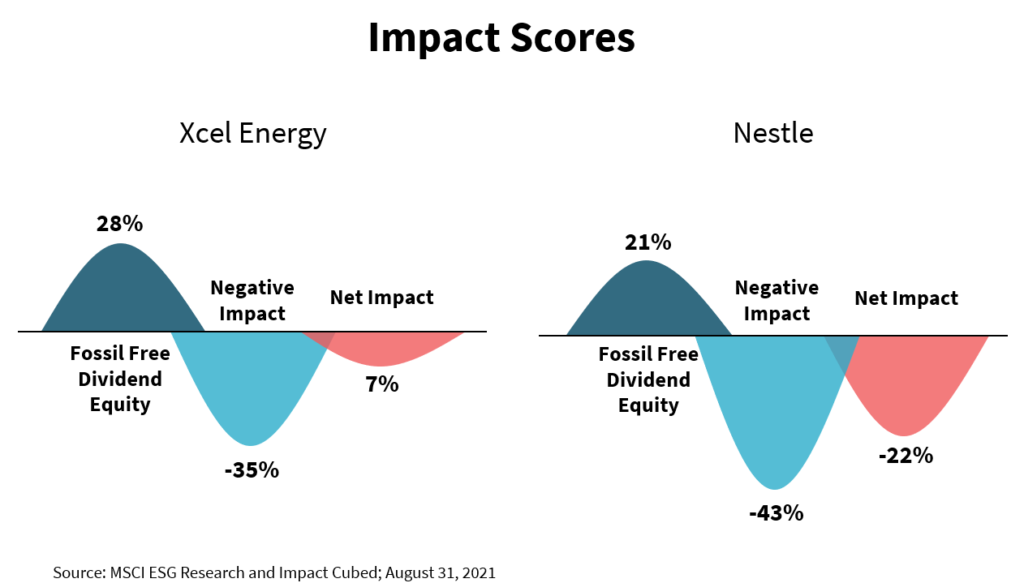

Genus Capital Management’s Net Impact Score™ lets investors check their portfolio’s positive, negative, and net environmental impact, setting us all up for a win.

While there’s never been more movement in the shift towards sustainable and impact investing, measurement of that impact is central to maintaining the momentum.

Recognizing that tools to quantify an investment’s impact weren’t easily accessed and deployed by the average investor, a Genus Capital Management team set out to create a measuring method that’s within just about everyone’s reach, although developing it was a bit of a journey.

Being the first tool of this type in Canada, the method for it had to be developed from scratch and the data needed to do this wasn’t easy to find. The Genus team’s drive to find a way for the average investor to measure net impact led them to talk to experts globally and try other tools available elsewhere. The success of the project hinged upon determining the specific needs of investors and no small amount of effort went into determining what a successful, user-friendly tool would look like.

The development of the scoring methodology––the team, led by Mike Thiessen, eventually found the necessary data––marked a milestone for the project. A system for calculating scores for portfolios then had to be developed, they call it the Net Impact Score™.

Thiessen worked with Genus Operations and IT teams to build logic to not only measure but automatically report the Net Impact Score™ of the portfolios that were entered in their systems.

Many trial portfolios were run through in order to test the tool before a rollout and education process could begin. To raise the level of awareness about their product and make Net Impact Score™ even more user-friendly, the team did interviews and presentations, wrote articles, and held webinars, all designed to help investors learn their “score.” This outreach helped break down the misconception some investors had that the tool would be tricky to use.

The team was later able to measure the impact the tool had on investors, including their own clients. Launching a Net Impact Ranking to further share the Net Impact Score™, Thiessen and a team of four MBA students reached out to two hundred institutions across Canada in order to measure their portfolios with Net Impact. These institutions were then ranked in a report and the team began working with investors to help them increase their score for next year.

All in all, Net Impact Score™’s performance and reach have exceeded expectations. More than one thousand investors, at many institutions, have had their Net Impact measured, and non-clients have reached out to learn more about the score.

The Net Impact Score™ also provides a way for institutional investors to communicate their impact goals and results to their stakeholders clearly and consistently.

Impact investing education is a gap in the Canadian market, the tool not only increases general and investor awareness of the practice, but also encourages the sharing of best practices in newspapers, media outlets, and among large asset owners.

The hope is that Net Impact Score™’s initial success will encourage more and more investors to measure their impact moving forward. Furthermore, sustainable investing in Canada is ever-growing and some of that positive growth can be attributed to Net Impact Score™.

At Genus’ investment portfolios, that growth can be measured. Fossil Free AUM grew 34% and Impact Investing grew 72% in 2020. This far exceeded the team’s expectations for the year.

It looks like Genus Capital Management’s Net Impact Score™ is a win we needed.