Indigenous Sustainable Bond Framework (ISBF)

Projects Sponsor

Indigenous Peoples in Canada (Inuit, Métis and First Nations) face significant socioeconomic gaps compared to non-Indigenous populations and often lack access to low-cost financing exacerbating this serious inequity. To help address this, Addenda Capital, First Nations Major Project Coalition, First Nations Financial Management Board and Roundtable Chair Geordie Hungerford brought together Indigenous and sustainability leaders to begin shaping an Indigenous Sustainable Bond Framework. The roundtable and resulting research bridges perspectives from the Indigenous and Sustainable Investing world and envisions a model that could direct billions in capital toward genuinely beneficial projects for, and most importantly with, Indigenous communities.

Many Indigenous communities lack financing for basic community needs, including adequate housing, healthcare, community facilities and water infrastructure. Indigenous businesses, households, communities and Nations face multiple barriers to accessing the funds their communities need to thrive. These include legal and regulatory barriers such as section 89 of the Indian Act which prohibits use of Indigenous property on reserve as collateral.

Astoundingly, while Indigenous Peoples in Canada account for approximately 5% of the population, Indigenous businesses hold less than 0.2% of the available credit. Access to market capital for Indigenous businesses is 11 times lower than that of non-Indigenous business peers.

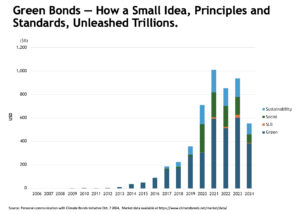

Taking inspiration from green social and sustainability bonds, the above collaborators, set out to study how to develop a framework that could help create an Indigenous sustainable bond market. Green social and sustainability bonds have emerged as some of the most exciting stories of sustainable investing. Indeed, since their first issuance in 2007, green social and sustainability bonds debt instruments have grown to over $5 trillion USD, providing financing for projects with measurable positive environmental or social outcomes.

Taking inspiration from green social and sustainability bonds, the above collaborators, set out to study how to develop a framework that could help create an Indigenous sustainable bond market. Green social and sustainability bonds have emerged as some of the most exciting stories of sustainable investing. Indeed, since their first issuance in 2007, green social and sustainability bonds debt instruments have grown to over $5 trillion USD, providing financing for projects with measurable positive environmental or social outcomes.

It was clear to the team, that there were valuable lessons to be learned from this success. In particular, the power of Green Bond Principles and the importance of a clear taxonomy of what qualifies as sustainable bonds. They recognized that a similarly well-designed framework, based on sound foundational principles and guidelines, could help create an Indigenous bond market capable as an additional means to attract the capital Indigenous communities need.

To get things going, background research was conducted compiling the state of Indigenous financing in Canada. The paper also laid out the foundational elements that made green bonds successful and proposed key questions that needed to be addressed in order to develop a credible and authentic Indigenous Sustainable Bond framework.

Through the collaborative roundtable hosted by First Nations Financial Management Board (FMB), First Nations Major Project Coalition (FNMPC), and Addenda Capital and chaired by Geordie Hungerford, participants including Indigenous Rights Holders, Indigenous organizations, green and sustainable bond issuers, investors, and standard setters came together to share their ideas and thoughts on the potential benefits, challenges, and path forward in developing an Indigenous sustainable bond framework.

Through in-depth discussions, breakout groups, and follow up research a set of key recommendations emerged on the critical elements needed for success..

These groundbreaking and bridge-building discussions provided a core set of recommendations. The first being the importance of establishing an Indigenous-led secretariat that develops the principles and framework in alignment with the UN Declaration of the Rights of Indigenous Peoples and Free Prior and Informed Consent.

Caution was recommended to allow time for the Indigenous Sustainable Bond Framework to be developed by Indigenous rights holders and leaders. The finance industry, given the business and market opportunities, tends to push for rapid development, but the paper provides strong evidence and messaging to the contrary. Process and final principles must allow for the proper time and respect while showcasing best practices in free, prior and informed consent (FPIC) and rooted in the guiding principle “Nothing about us without us.”

While the goal of the project is obviously to unleash potentially billions in capital toward genuinely beneficial projects in Indigenous communities, the work here is beneficial for all Canadians. Building a prosperous Canada with strong economic development, energy security, and sustainability means creating a deeper, more sincere partnership with Indigenous communities. The key principles eventually developed here will serve as a guidepost for how to do this well.

The project so far has been about listening to a broad spectrum of views and voices, and trying to be an example of how to live according to FPIC — a new experience for many in the sustainable finance and financial community. But the financial community in Canada is paying attention. The paper has been featured at several bond, finance, and policy conference sessions and discussions. It has provided insights to the financial community that they must take care in what they claim to be doing related to Indigenous communities, and support the development of a clear standard to ensure authenticity and ultimately unleash more capital toward economic reconciliation.

The project so far has been about listening to a broad spectrum of views and voices, and trying to be an example of how to live according to FPIC — a new experience for many in the sustainable finance and financial community. But the financial community in Canada is paying attention. The paper has been featured at several bond, finance, and policy conference sessions and discussions. It has provided insights to the financial community that they must take care in what they claim to be doing related to Indigenous communities, and support the development of a clear standard to ensure authenticity and ultimately unleash more capital toward economic reconciliation.

Down the road, the global finance and sustainability community could well draw lessons from Addenda’s collaborative work here, applying these principles to Indigenous financing projects in other regions.

All going as planned, the Indigenous Sustainable Bond Framework recommendations will be a document that moves us—far more than a day late and many dollars short—closer to economic reconciliation.