Investi – The fund invested for sustainable finance, because everyone has a stake in fighting climate change

Projects Sponsor

Investi is an initiative led by Innocap, the global leader in managed account platforms, and by Finance Montréal, Quebec’s financial cluster, with the collaboration of 10 leading institutional investors (CDPQ, Trottier Family Foundation, Fondaction, Fonds de solidarité FTQ, Samara, Beneva, Optimum, National Bank Investments, Desjardins and Bâtirente). By creating collaboration tools such as Investi, this group strongly believes they can help break down the most common barriers to innovation and allow institutional investors to allocate more assets, faster, to new and innovative sustainable investment approaches.

There’s no question that there are often significant barriers to innovation in sustainable investment for both asset allocators and asset managers. Constraints linked to investment policies, such as performance history criteria (at least 3 years), the size of the investment fund, etc., limit the number of institutional investors capable of supporting new strategies in getting off the ground.

Investi provides a solution to this problem by enabling institutional investors to pool assets and invest in innovative strategies at launch or early stage. Pooling investors’ assets also reduces the impact of the investment vehicle’s operating costs and helps mitigate manager selection risks through strong governance, supported by committees made up of experts in investment and sustainability from Quebec’s sophisticated institutional investors.

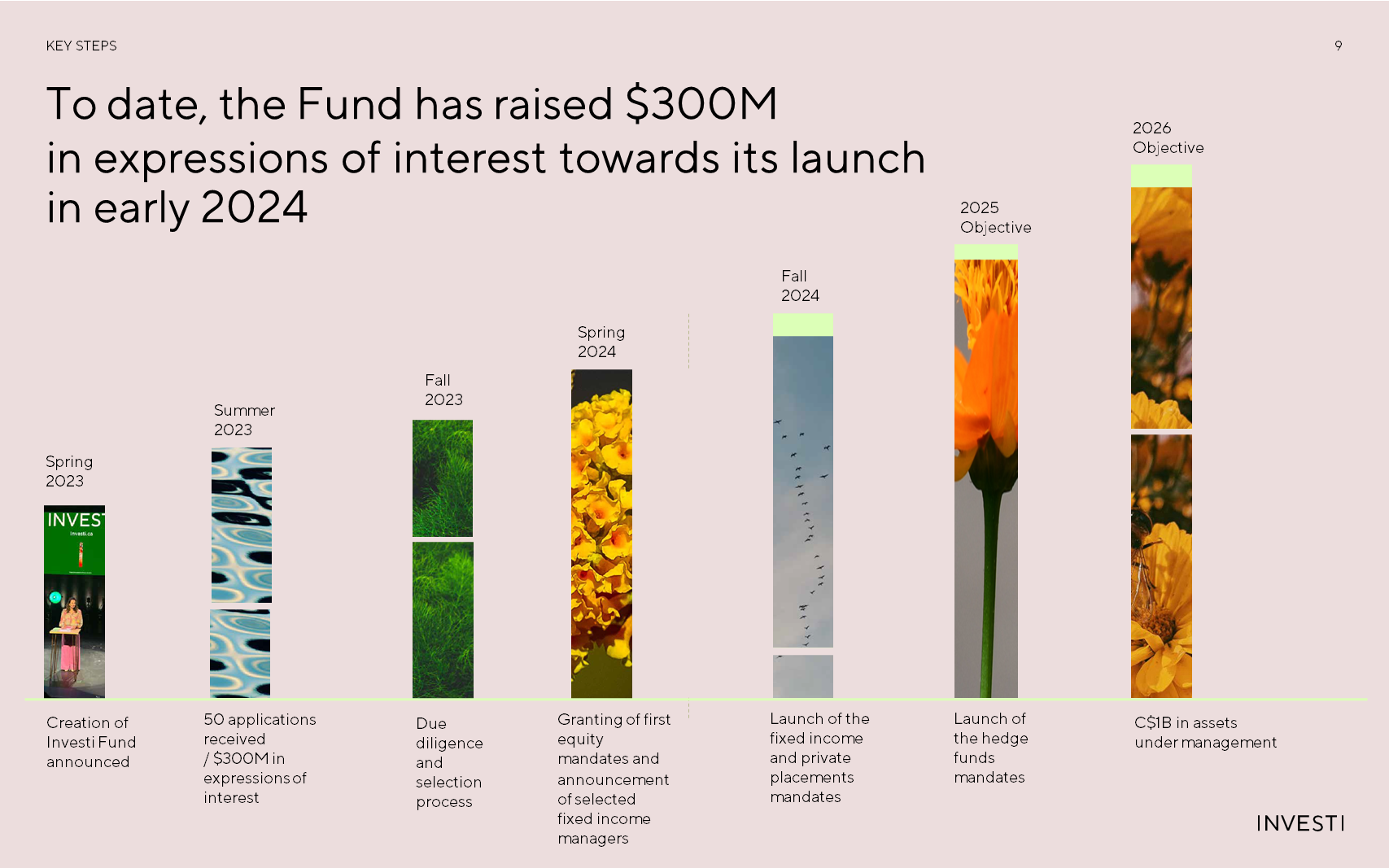

Having raised over $300 million in expressions of interest, Investi’s objective is to raise up to $1 billion in assets by 2026 and to allocate all assets to firms based in Quebec (or opening offices in Quebec), in order to foster the already booming Quebec sustainable finance ecosystem.

Investi is based on an assessment conducted by Finance Montréal, in collaboration with Innocap and various stakeholders of the Quebec financial ecosystem that led to the creation of such a mechanism. The research concluded that collaboration was critical, and could be fostered with an investment vehicle that would allow various institutional investors to, together, invest more and faster with innovative sustainable investment strategies.

Collaboration between various stakeholders being core to Investi, the fund benefits from the continuous collaboration and the unwavering involvement of its instigating investors as members of its governance and investment committees. Funds are allocated to experienced managers who offer innovative sustainable investment approaches in four distinct asset classes: equities, fixed income, hedge funds, and private assets.

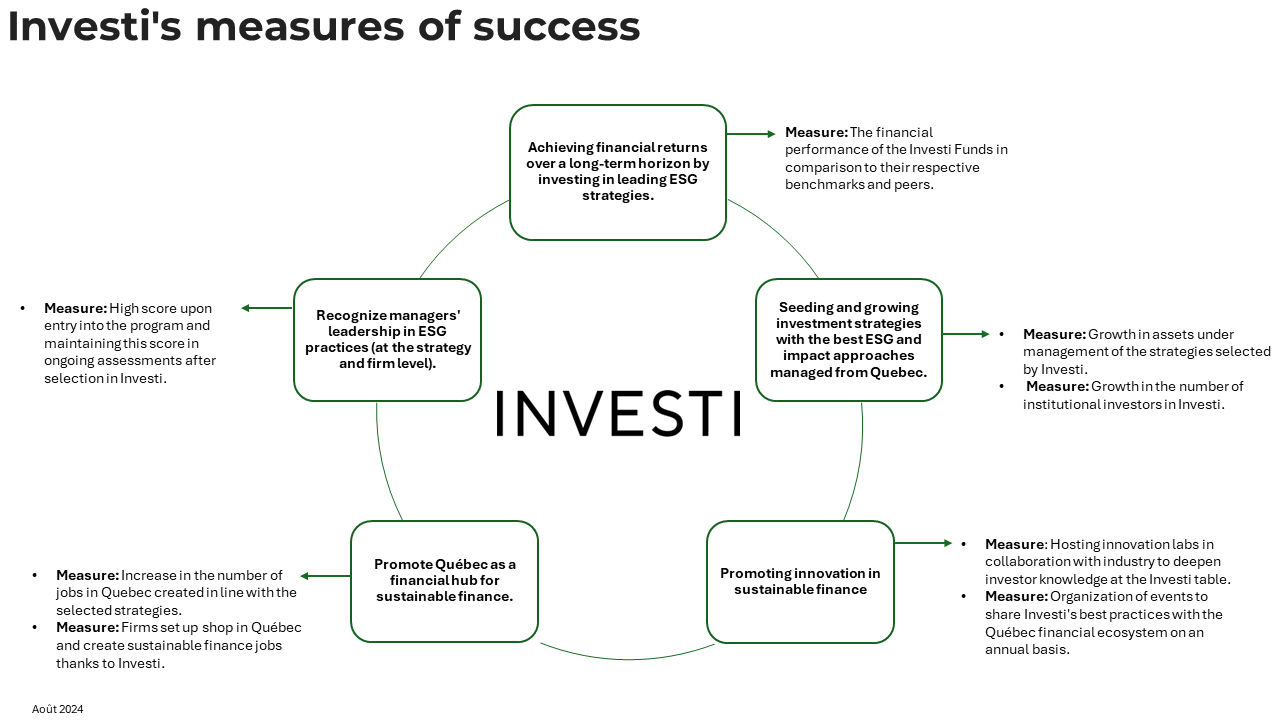

Selected firms are required to demonstrate ESG integration both at firm and strategy level. At the strategy level, managers must outline what sets them apart from their global peers in terms of ESG integration and sustainability. This is achieved through consideration of ESG materiality criteria, shareholder engagement approach, ESG due diligence of portfolio companies, approach to voting rights and stewardship, monitoring of ESG and/or sustainability indicators, ESG risk management, accountability, and transparency. It also includes climate change assessment of the assets and strategy and the ability to demonstrate how the strategy aims to reach its quantifiable commitments (e.g. GHG reduction).

To ensure a demonstrable impact on risk-adjusted returns, selected firms must have a robust investment process that has created strong added value, and must rank favourably against comparable strategies in addition to a verifiable performance track record of at least three years for a similar strategy. The Fund’s core-satellite approach consists of experienced managers offering both proven value-added strategies and verifiable performance history, along with strategies at the embryonic stage or with limited performance history but based on proven processes.

In February 2024, the Fund announced the selection of its first two firms in the equity asset class: Manulife and Van Berkom. In May 2024, the selection for fixed-income strategies included pioneering firms such as Addenda Capital, firms with expansion plans in Quebec such as Beutel Goodman, and large-scale firms such as Fiera Capital, all of which have a common desire to elevate their practices and position Montreal as a centre of excellence in sustainable finance. These firms stood out for their demonstrated financial performance and the robustness of their ESG approaches.

Investi believes that engaging with asset managers prior to and post-selection is critical to share best practices and to foster a culture of continuous improvement. In 2024, aiming to stimulate innovation in sustainable finance even further, Investi launched its first Innovation Lab, a concertation table where investors study and assess, together with external experts from various horizons, how to invest at scale in up-and-coming or under-invested sustainability areas.

Relatively new on the horizon as it is, Investi’s impacts are measurable in terms of growth in assets, owing to the strategies they invested in, diversity of investors investing in such strategies (showing that such investments are becoming more mainstream), maturity of the products getting to market, and increase in the number of firms in Quebec offering investment strategies with a sustainable approach.

Collaboration between institutional investors looking to work together to foster the local sustainable finance ecosystem has made Investi a successful fund, and Innocap invites all investors to connect with them to be part of Investi’s journey and invest alongside its anchor investors. But Investi’s goal is to be more than a fund – they want to become an infrastructure for learning and sharing best practices, and they hope others will be inspired to run with their success. A more sustainable future needs lots of Investi clones elsewhere, potentially across Canada, and the world, supporting the enterprises and innovations that will help decarbonize the economy, because everyone has a stake in fighting climate change.