KingSett Capital Forges a Tool to Build the Case for Decarbonization

Projects Sponsor

KingSett has developed a tool to model different approaches used to decarbonize existing buildings and make the case for decarbonization over replacement.

KingSett Capital’s Building Decarbonization Financial Modelling Tool was created out of necessity — basically, economic necessity. The private equity real estate investment firm’s Environmental, Social, and Governance team wanted to achieve buy-in and secure capital investment for decarbonization over high-efficiency replacement. This, coupled with pressure to set stringent carbon reduction targets across the portfolio, led the team to build a tool that captures the key financial inputs necessary to make a business case for deep carbon retrofits in existing buildings.

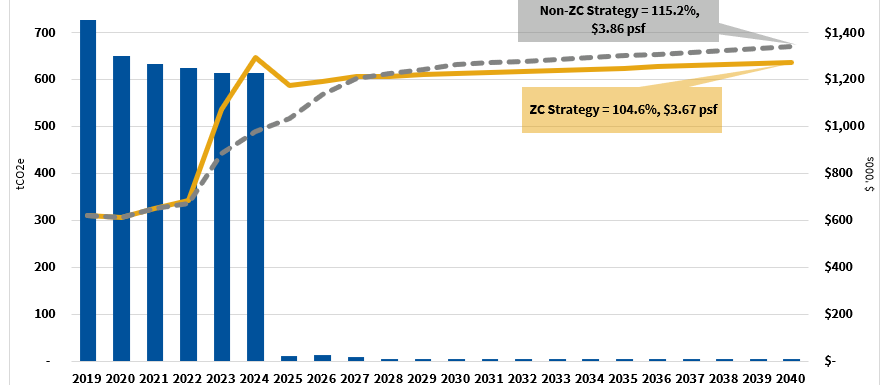

The underlying principle of the project was that completing deep carbon retrofits is not only beneficial for carbon reductions, but also has a significant positive impact on the building’s operating costs. However, to get those retrofits financed and finished, you need to be able to show your work.

Having a tool that can demonstrate the impact sustainability measures have on operational costs, energy performance, carbon reductions, and mitigation of future transition risks (climate regulation and carbon tax), opens the door to close a lot of doors left pointlessly open with obsolete energy-hogging heating systems running, and much, much more.

Launching the tool was a three-year endeavour. Background research on the structure and components needed to finalize the key metrics and dashboards was the first step. Then, having determined there were no off-the-shelf products already available that fit the bill, the team created a list of all data points required, including findings from building level reports and audits, baseline utility data, assumptions on utility inflation and reductions, escalations in the carbon tax, and capital inputs and amortization schedules.

Of course, the team had to ensure all properties could utilize different baseline and decarbonization years without causing errors in the model. As with many projects, one of the greatest challenges was overcoming changes in scope that would lead to near rebuilds of an ever-changing Excel model. Year-over-year changes in inflation, consumption, carbon tax, capital expenditure, and emission factors also made automation across their entire portfolio a challenge.

The initial model expanded substantially as new factors and metrics that could have a material impact on the ultimate decision to decarbonize a building were incorporated. A single property uses a minimum of 3,800 data points, so producing a single dashboard able to model scenarios that can be easily understood makes for a very tricky build, requiring a lot of time, troubleshooting, and teamwork.

Indeed, the tool would go through more than twenty iterations before the team considered it market ready and it may not have yet reached its final form.

As built, the tool has certainly enabled KingSett to conduct analysis, achieve buy-in, and ultimately set actionable targets and execute projects but KingSett has also said, “Over to you.”

The final free product is a living model, one the user is free to edit in all fields. The released version allows users to customize data points and conduct sensitivity analysis at both a property and portfolio level in order to meet their organization’s specific needs and allow them to work toward their decarbonization targets and goals.

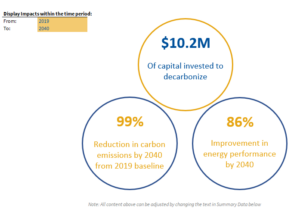

The impacts of utilizing this model cannot be understated for KingSett. Being able to compute and communicate the potential savings in energy to asset managers and owners has brought significant buy-in and access to capital to fund their decarbonization pipeline. They’ve already decarbonized 1.8M sf with another 3.4M sf in their decarbonization pipeline set to be completed by 2027, leading to a 35% reduction in carbon emissions over baseline for the core fund properties.

The company’s current Royal York Hotel project, scheduled to be completed by the end of 2023, will reduce over 80% of the 1.3M sf century-old historical building’s carbon emissions. KingSett’s Building Decarbonization Financial Modelling Tool is also helping to secure lending through the Canadian Infrastructure Bank for the core fund and $46M for the Royal York Hotel alone.

Other property management firms can pick up the tool and wield it as well, as we tackle the climate crisis together.