Why Waste is Becoming an Investment Opportunity

The circular bioeconomy, focusing on optimizing resource recovery from organic waste, presents opportunities for sustainable products and energy sources. Dr. Love-Ese Chile, Founder & CEO at Regenerative Waste Labs, discusses the global demand for renewable bioproducts and how Canada can capitalize on it with supportive regulations, incentives, and innovative business models.

Canada, like the rest of the world, finds itself at a crossroads, navigating the uncertain waters of climate change, global events, and economic challenges. In response, we are beginning the transition to a low-carbon economy, necessary to secure Canada’s long-term prosperity. A successful transition will involve mitigating climate change by cutting emissions and addressing its root causes, while accelerating action to adapt to changes already happening.

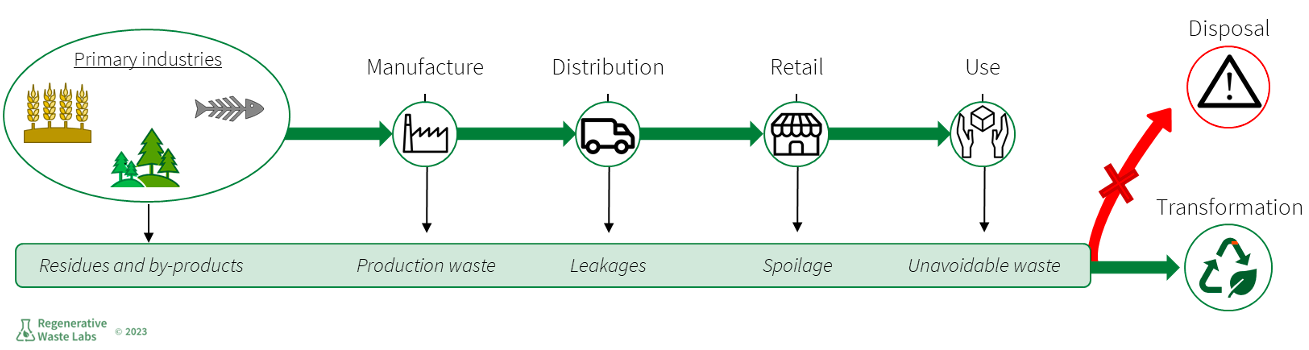

In a rapidly evolving economic and environmental context, onshoring, or localizing production and manufacturing value chains, will safeguard Canadian businesses against the vulnerabilities of global supply chain disruptions. Onshoring provides an opportunity to strengthen regional economies through optimized resource recovery by creating new markets for commodities from primary sectors like agri-food, which produces substantial biomass and generates significant waste. Facilitating the growth of the circular bioeconomy is a key component to building resilient and sustainable communities, where waste is reduced, and biomass is repurposed into valuable products. The core principle of a circular bioeconomy is to maximize the value from agricultural residues, food by-products, and organic waste by encouraging reuse, recycling, and transformation, keeping these resources within the economy for as long as possible (Figure 1).

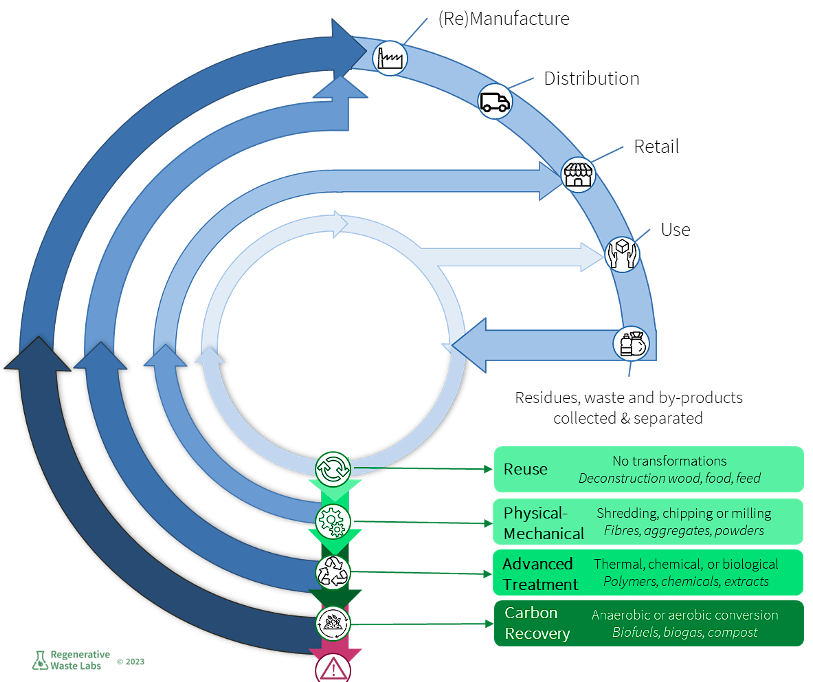

Various low-carbon and regenerative products can be derived from organic waste through conventional and advanced recovery processes. Physical-mechanical processing can involve shredding, chipping, or milling agricultural residues to create secondary bioresources without significantly changing its chemical structure. These processes can result in fibres for textiles, aggregates for construction, and powders for various industrial uses. Alternatively, organic wastes can undergo thermal, chemical, or biological treatment and extraction to generate polymers, platform and fine chemicals and valuable extracts. These secondary materials can be integrated directly into manufacturing, pharmaceuticals, or cosmetics, reducing the need for new, non-renewable resources. Carbon recovery from organic waste has a dual benefit. It can be converted into renewable energy sources like biofuels and biogas, contributing to a cleaner energy mix and reducing dependence on fossil fuels. It can also be transformed into environmentally beneficial products such as compost and biofertilizers, supporting agriculture and soil health (Figure 2).

The global demand for renewable bioproducts was estimated to be $CAD 194 billion in 2022 with North America accounting for 40% of the market. The value of this industry is expected to increase at a compound annual growth rate of 10-15% over the next 10 years presenting a significant export opportunity for Canadian-made bioproducts into applications like consumer goods, packaging, building materials, fine chemicals, and bioenergy. Online material databases already boast upwards of 5,000 unique bioproduct innovations that incorporate recovered biomass with applications across various industries. To name a few, kelp materials are being used in food packaging, shellfish-derived chitosan has found a role in compostable foam packaging, and plant fibres are contributing to the production of sustainable textiles.

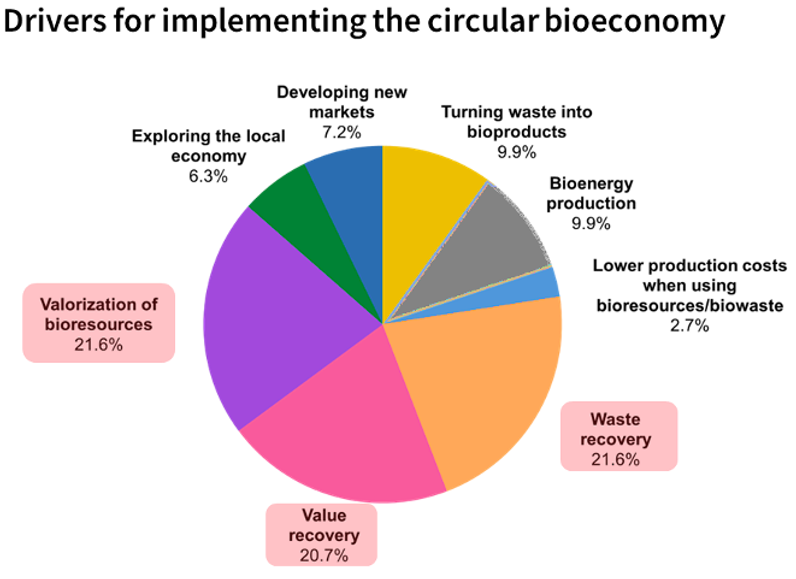

There is significant potential in the circular bioeconomy, but growing its related industries here in Canada requires a balanced interplay between regulatory frameworks and pragmatic investment (Figure 3). Regulations provide clarity and predictability for businesses, investors, and stakeholders, reducing uncertainty and creating a more favourable investment climate.

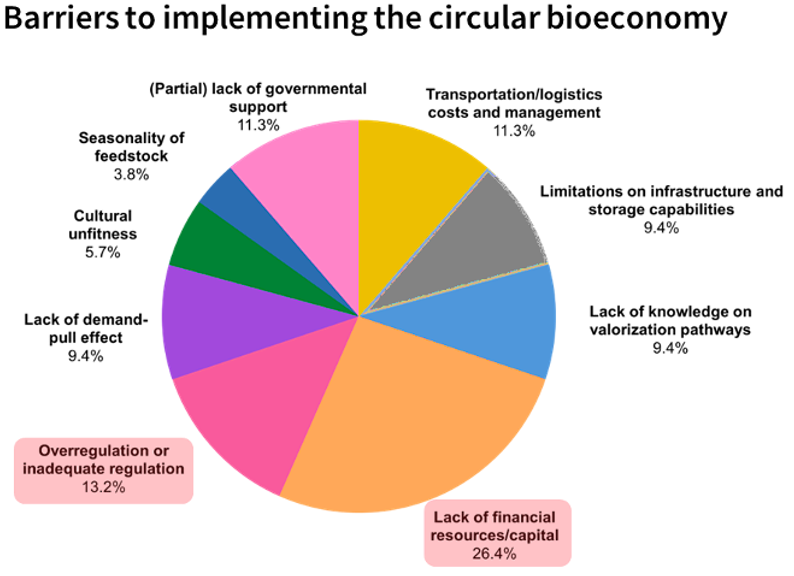

Governments can drive market expansion for a broader range of products and materials derived from local bio-waste by prioritizing innovation that will support various stakeholders to reduce risk and ensure environmental compliance. Key policies to enable value recovery from waste should remove obstacles and promote bioresource recycling. Incentives such as tax credits or grants encourage businesses to adopt circular bioeconomy solutions. For instance, governments can provide subsidies to agri-food businesses that invest in technologies and processes to extract value from their operational waste. Regulations can set specific targets for agri-food businesses to repurpose a certain proportion of their waste as value-added products. Enforcing requirements for agri-food companies to report on their waste, will ensure transparency and highlight additional opportunities for additional innovation. Governments can create market demand by establishing standards for the minimum recycled and renewable content in various products, promoting circular use of resources. Tax credits and guidelines for sustainable procurement would support businesses in selecting local products and materials.

Alongside bioproduct innovations and advanced processing technologies, progressive business models are emerging as additional investment opportunities. These models can include cooperative arrangements for transportation and storage, specialized commodity brokerages focused on bio feedstocks, or material testing services. To ensure access to bioproducts and related services are widely accessible, investment frameworks which cater to longer-term objectives and sustainable infrastructure development are essential. Unlike traditional equity models that prioritize quick returns and exit strategies, sustainable financing models can involve patient capital, which is willing to invest over extended periods, or investments that are repaid based on a percentage of the project’s revenue over time. Furthermore, investing in the development and expansion of local and global markets can create new avenues for growth, strengthening the economic potential of circular bioeconomy ventures.

“Alongside bioproduct innovations and advanced processing technologies, progressive business models are emerging as additional investment opportunities”

Dr. Love-Ese Chile

The Canadian circular bioeconomy continues to evolve, and adoption of resource recovery pathways is gaining traction as a means to enhance profitability and reduce environmental impact. The circular bioeconomy isn’t just a concept; it’s the practical road-map to a low-carbon future for Canada, which strikes a balance between environmental stewardship and economic growth. Driven through a cooperative effort involving policymakers, businesses, investors, and communities, the opportunity of the circular bioeconomy awaits our collective commitment to realize its full potential.

References

Precedence Research, Biomaterials Market Size, Share, & Growth Analysis Report – Global Industry Analysis, Trends, Regional Outlook, and Forecasts 2023 – 2032.

Reports Insights, Biomaterials Market Size, Share & Trends Analysis – Forecast Period 2023 – 2030.

Tocco, https://tocco.earth/

Material District, https://materialdistrict.com/

Rodrigo Salvador 2022. How to advance regional circular bioeconomy systems? Identifying barriers, challenges, drivers, and opportunities.