Why Canada Needs a Sustainable Finance Taxonomy

With thanks to Dilhari Fernando (for the explainers) and Mitchell Beer (lots of news and related links) this page is a comprehensive resource on understanding both the need for – and challenges facing – the implementation of a Sustainable Finance Taxonomy in Canada.

Read the full, released letter at https://clean50.com/open-letter-clean-taxonomy/

What is a “Sustainable Finance Taxonomy”?

A “taxonomy” is akin to a guideline, classification system or screening criteria to help decision makers to make informed choices in support of a broader goal.

A Sustainable Finance Taxonomy is a set of guidelines that institutional and private investors, banks and insurance companies can use to narrow down and decide in which activities to invest in order to support climate change goals. A Sustainable Finance Taxonomy is an important tool to mobilize and accelerate the flow of capital toward climate change objectives.

Why does Canada need a Sustainable Finance Taxonomy?

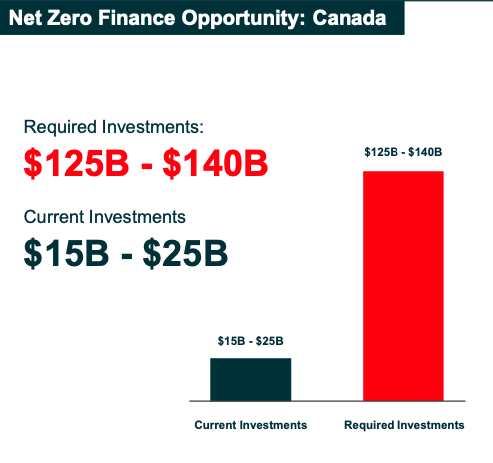

To meet our commitment to reach net-zero emissions by 2050, Canada needs to increase its climate investment by an estimated C$115B/year (Taxonomy Roadmap Report, 2022). To date, there is no common approach among investors to decide whether an activity will support the transition to net-zero.

While some organizations have created in-house taxonomies, there is no one “made in Canada” taxonomy that can be adopted by national and global investors looking to invest in Canadian green and transition activities. As a result, there is a confidence gap when making climate-related investments resulting in both delays and reduced levels of capital flowing to climate-related projects. Moreover, where investments are being made, some of these investments may not yield the climate benefits desired. Lastly, given the lack of a unified approach, communicating and transparently reporting on the impact of investments has become challenging, and at times, misleading.

Progress to Date in Canada

Work on a Canadian Sustainable Finance Taxonomy was launched in April 2018 with the appointment of the Expert Panel on Sustainable Finance. Their comprehensive June 2019 Final Report included recommendations that linked Canada’s climate objectives, economic ambitions and investment imperatives. The Expert Panel also recommended that the Sustainable Finance Action Council (SFAC) be struck to further examine the concept of the Taxonomy and integrate sustainable finance principals into mainstream industry practices. In 2022, the SFAC released its Taxonomy Roadmap Report that included clear recommendations to develop a green and transition taxonomy and to create a governance mechanism to develop and oversee its deployment.

The Canadian Government and finance community are seized with the need for a made in Canada taxonomy that aligns with our net-zero ambitions and fits within our socio-economic context.

What will a Canadian Sustainable Finance Taxonomy Contain

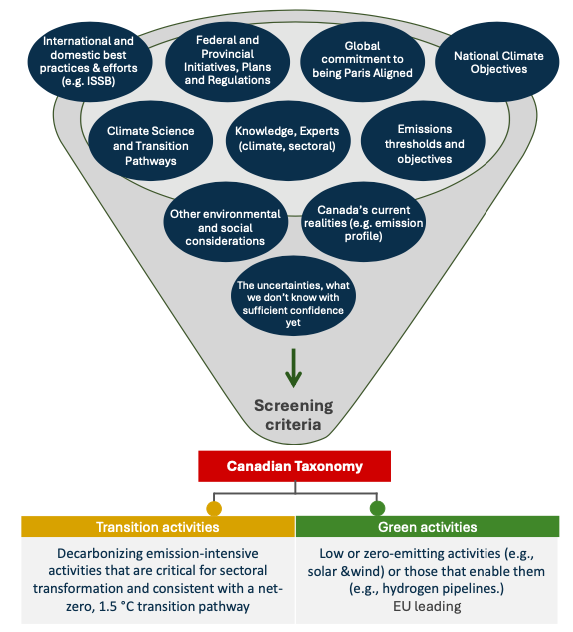

At a high level, a Canadian Sustainable Finance Taxonomy will create guidelines to screen economic activities (e.g. assets, projects, revenue streams) based on the activities’ potential to help achieve Canada’s emission reduction targets and to keep global temperature rise to below 1.5C. Projects will be screened as being green or transition, and assessed to ensure it does “no significant harm”, meaning that its benefits to the environment and society would outweigh any potential harm it may pose.

The Canadian Sustainable Finance Taxonomy will also contain a prioritization framework to help filter the highest priority sectors, industries and activities (from the broader universe of economic activities) that offer the greatest potential to reach the objective(s) set out by the taxonomy.

Projects that are considered high risk in terms of stranded assets, carbon lock-in and incompatibility with a 1.5C pathway would be ineligible for investment under the Taxonomy.

Summary of Benefits

Once fully developed and implemented, the Taxonomy will benefit financial and non-financial firms and non-profits, as well as support broader socio-economic goals, transparency, and the just transition.

Benefits of the Taxonomy include:

- Valuable tool for investors and bankers to more confidently channel capital into green and transition projects to help fill the climate finance gap.

- Positioning Canada as a more attractive investment destination for Canadian and global investors.

- Helping companies attract capital to finance their climate transition plans and potentially accelerate firms’ operational and supply chain decarbonization.

- Attracting capital for development and scaling up of clean tech and other new innovations.

- Facilitating investors and companies’ abilities to align with rapidly evolving sustainability reporting requirements under the International Sustainability Standards Board and the Canadian Sustainability Standards Board.

- Reducing greenwashing and mis-information.

- Upholding the key principle of “do no significant harm” to ensure that activities and projects have a net-positive environmental and societal impact.

Learn More With These Resources

- Investment Executive’s FAQ’s on Taxonomy:

• Executive Summary: Understanding Canada’s proposed climate finance taxonomy • Extended Version: 10 Questions About Canada’s Green & Transition Finance Taxonomy, Answered - 5 big questions about Canada’s new Climate Investment Taxonomy by Canadian Climate Institute

- Briefing Note on Canada’s Transition & Green Taxonomy by the Institute of Sustainable Finance

- Videos:

• https://smith.queensu.ca/>/isf/resources/taxonomies-resources.php

• Expert Panel on Sustainable Finance, report written by Clean50 Alumni Sean Clary

With thanks to Mitchell Beer, links to more news and information From The Mix:

From other organizations and news outlets:

https://www.tsx.com/company-services/learning-academy?id=696